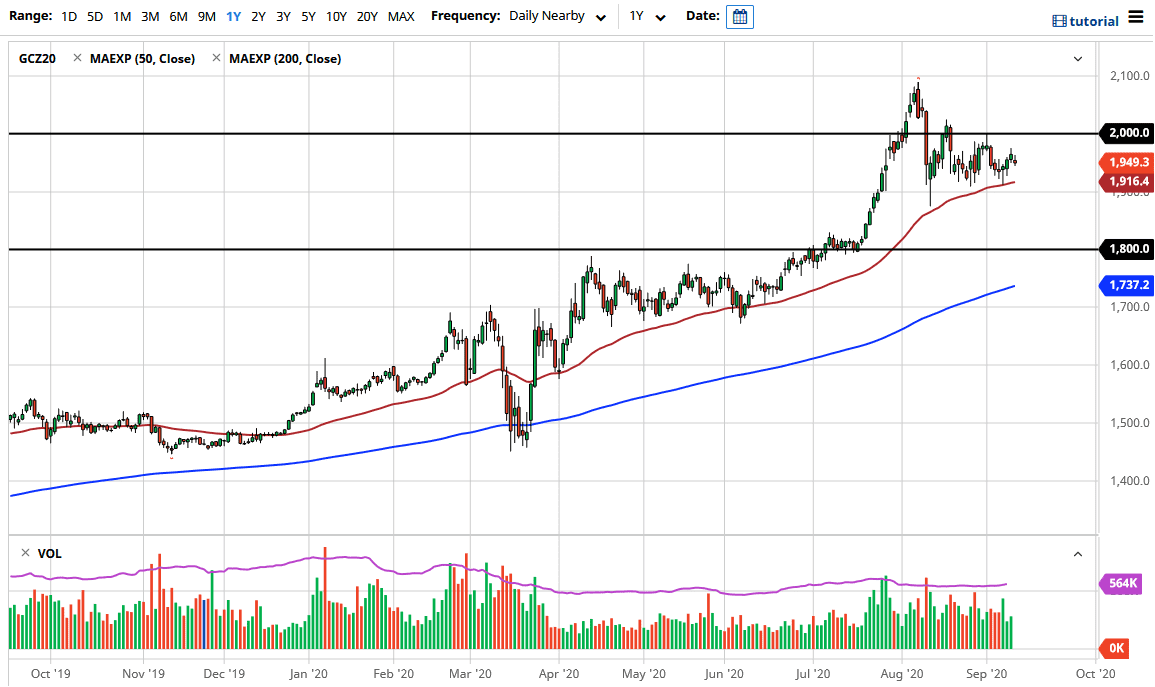

Gold markets were a bit neutral during the trading session on Friday, after gapping lower. Ultimately, this is a market that I think continues to see a lot of volatility, mainly due to the fact that the US dollar is all over the place. This is a market that I think will continue to see a lot of interest, and the fact that we are sitting halfway between a major support level in the form of the $1900 level and a major resistance barrier in the form of $2000. If that is the case, then it should not be surprising that we are going to see a lot of choppy behavior.

At this point, it is only a matter of time before we see some type of impulsive move, based upon what is going on with the US dollar. Right now, it looks as if it is trying to recover a bit of the loss as of late, so it does make sense that precious metals have taken it on the chin a bit. Nonetheless, we are still very much in an uptrend when it comes to gold and silver, so I think that they both will eventually find buyers.

Having said all of that, if we do break down below the $1900 level, I think that we will go looking towards the $1800 level, which would be even more structurally important based upon the fact that it was massive resistance previously. With this, I think that the market will continue to see choppiness but most certainly a lot of interest due to the fact that the Federal Reserve and several central banks around the world continue to liquefy the markets, and other words bringing down the value of fiat currency. If you have the ability to trade gold and other currencies, that might be something to look into as well, because the market is likely to see even more quantitative easing down the road. People are looking to protect their wealth, and that is the main theme here. Beyond that, we also have a lot of concerns when it comes to global growth, so that is going to be a major problem as well. Over the longer term, I do believe that we not only break above the $2000 level, but we will also then go looking towards the highs again.