Gold markets have initially fallen during the trading session but turned around quite nicely later in the day on Thursday as the US dollar got sold off in late New York trading. All things being equal, this is a market that I think continues to look for a bottom and a short-term rally probably is what we are going to see but not necessarily enough to get me involved quite yet.

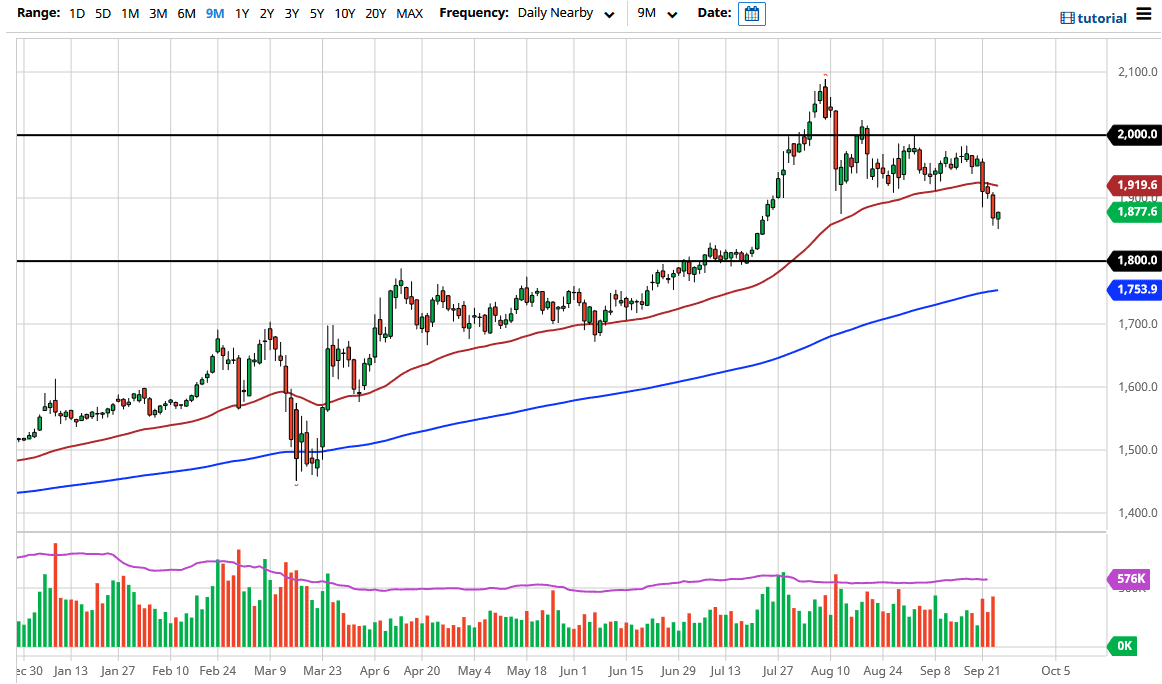

The US dollar is going to be the key for figuring out where precious metals go in general, and of course the gold markets are highly influenced by the greenback. That being said, I like the idea of buying gold at lower levels, especially near the $1800 level. That is an area that has been structurally important in the past, as it was where we had broken out of, and of course it is a large, round, psychologically significant figure. With all of that being said, it is likely that people will pay quite a bit of attention to this figure. Adding even more significance is the 200 day EMA which is reaching towards the $1800 level as well. That being said, the market is very stringently supported underneath, but we need to come at this from a US dollar perspective. At this point, if the US dollar rallies, that works against gold and I do think that it will again, but we may have a day or two of weakness in the greenback pushing this market higher.

I believe that the 50 day EMA will probably cause some resistance over the next couple of days, and if that is going to be the case then you might get a short-term reach to the upside but I believe you will be able to find much more in the way of a bigger move closer to the $1800 level as it is structurally more important and it will have represented a much more significant pullback in what has been a very strong market. Longer-term, I believe that the gold markets will go much higher due to central bank interventions in the quantitative easing department, and of course the fact that there is a lot of concern out there based upon geopolitical risks as well. All things being equal, the gold market is one that I am a buyer of, and not a seller, but I would like to see lower pricing in order to pick up gold at a better entry price.