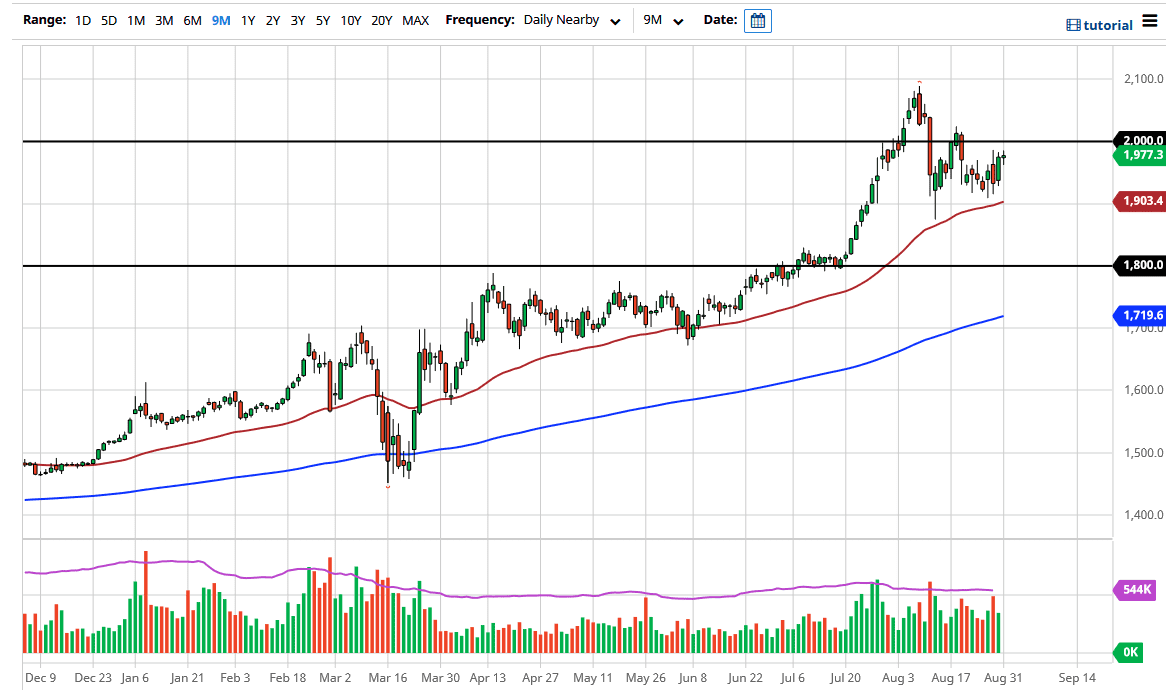

Because of this, I think it is only a matter of time before we go looking towards the $2000 level above. That is an area that obviously has a certain amount of psychological importance attached to it, but we have been through at previously. With that in mind, then it becomes resistance, and not supply which is a subtle but crucial difference. There will be less supply, i.e. selling, at that area and therefore it should be relatively doable to break through there.

Buying dips at this point continues to be a strategically something to do, especially with the $1900 level underneath offer and so much in the way of support. The 50 day EMA sits there, and of course is a large, round, psychologically significant figure. Furthermore, even if we do break down through all of that, there should be even more support closer to the $1800 level because it was so structurally crucial previously. The 200 day EMA is trying to get towards the $1800 level, and if it does before price gets there, then it will become much more supportive as well.

As long as the US dollar is in the downward trajectory, it is very difficult for gold to fall significantly. The market has been rallying for some time, and the fact that we have pulled back the way we have should not be a huge surprise considering how far we had gotten ahead of ourselves. With that in mind, we may have some digesting to do but longer-term goal market still a very healthy. I think that a lot of longer-term traders will be taking advantage of this, because as the market is relatively quiet, a lot of the so-called “hot money” jumps out and then we can start to focus on the longer-term macroeconomic situation again. That clearly favors metals over the US dollar, and if the Euro can break above the 1.20 level, it is likely that gold will shoot through the roof as well. Furthermore, pay attention to the US Dollar Index, it will give you a heads up as to what the US dollar is doing against almost everything else.