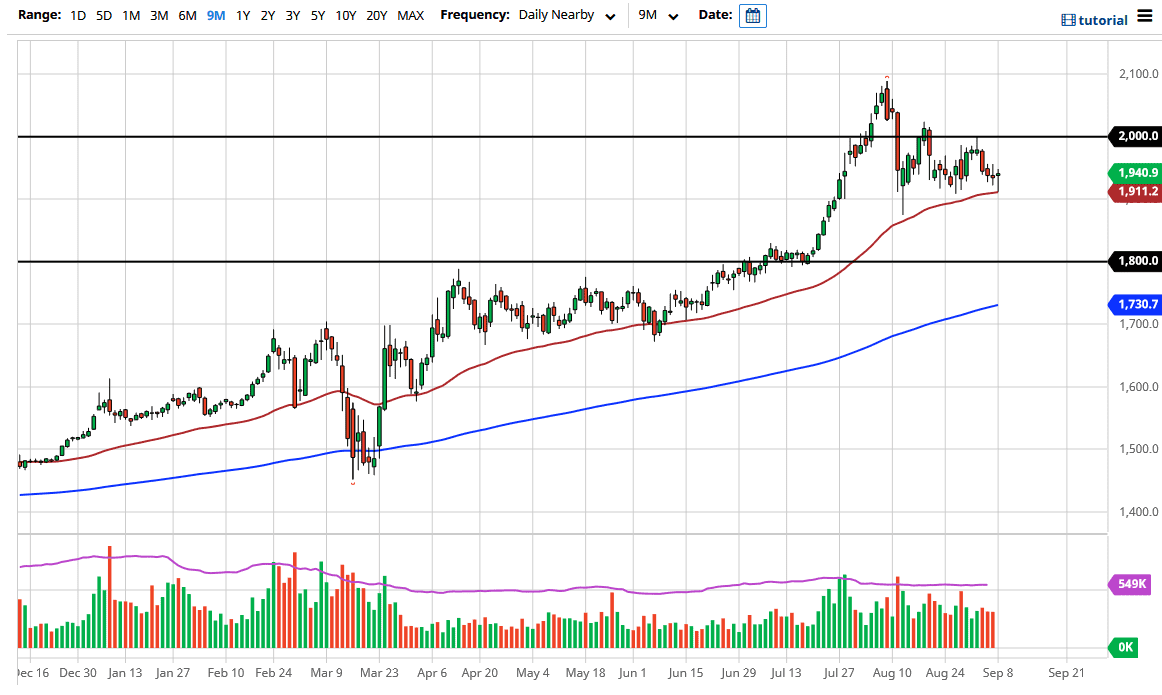

It looks as if we are going to continue to move back and forth based upon risk appetite as per usual, but more importantly the US dollar. If the US dollar gains strength, then it tends to work against the value of gold, and that is something worth paying attention to. If we break down below the 50 day EMA and we get US dollar strength, the gold market will probably go looking towards the $1900 level, which is an area that has been support more than once.

If we break down below there, then gold is likely to go reaching towards the $1800 level underneath which was massive resistance previously, and therefore should be structurally supported based upon market memory. I do not like the idea of shorting gold, so I think at this point I would simply wait for a buying opportunity down at that level if we do break down. On the other hand, if we do break above the top of the candlestick for the trading session on Tuesday, then we could go looking towards the $2000 level above which is a large, round, psychologically significant figure and an area where we had seen a lot of selling just a few sessions ago. If we can break above there, then it is likely that we go looking towards the $2100 level, perhaps even further than that.

I think at the very least we are looking at a lot of volatility just waiting to happen, so you are going to be much better served being cautious about the position size that you put on, as we could get sudden disruptions to the market considering how concerned people are. I think at this point in time, we are still very much in an uptrend, but we need to see this market prove itself relatively soon, or it runs the risk of people capitulating and sending it back down towards the $1800 level. The best thing you can do is place a trade, and then add slowly in order to build up a position size because we have the ECB later this week, and of course a lot of concerns about what the Federal Reserve is doing.