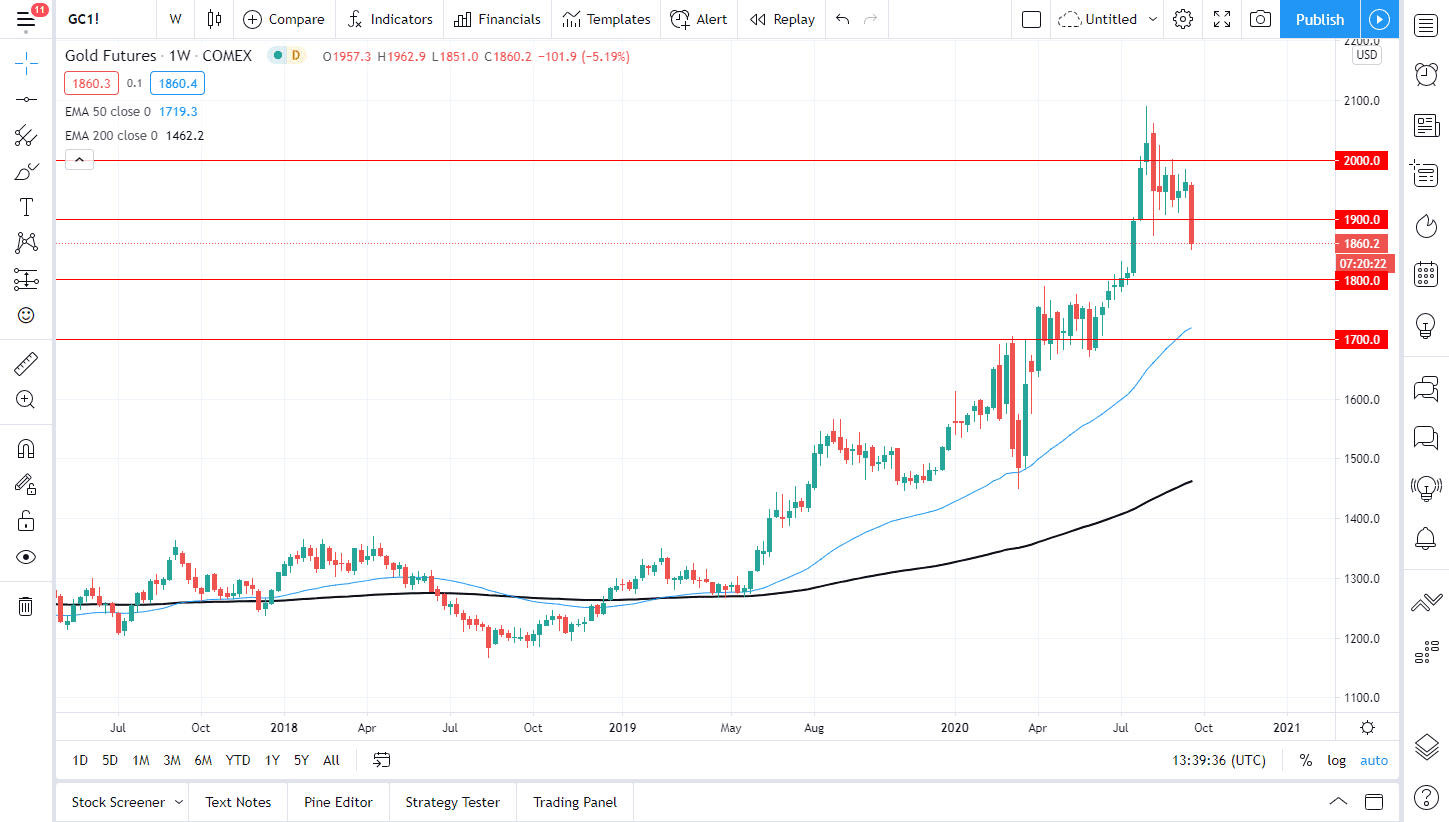

A quick glance at the weekly chart puts everything in perspective. We are most certainly in an uptrend and I just do not see that changing in the short term. That does not mean that it cannot, but the thing about the gold market is that the metal does tend to be very sensitive to the overall attitude of the US dollar. That is what has happened over the last couple of weeks, we have seen the US dollar take off.

All that being said, it is worth noting that the gold market held its own for quite some time and that tells me that longer-term goals going to go higher either way. Gold can and will rise right along with the US dollar, all one has to do is look back at the 1980s. That does not necessarily mean that the move in the same manner all the time, but over the longer term they can move in the same direction despite what you may have been told.

When I look at this chart, I believe that the $1800 level makes an excellent entry for those looking to pick up a bit of value. I also can make an argument for the $1700 level as well. Gold is going to get backing due to the central banks around the world loosen monetary policy and let us not forget central banks are massive buyers of gold at this point. This creates a certain amount of underlying demand, and therefore should be paid attention to as well.

The biggest problem gold has is that there is not concerns of inflation right now, so that does work against it. However, as there are so many risks out there and of course central banks around the world are printing currency, people are going to be looking to buy gold for the longer-term haul. With that in mind, buying dips should be the only thought that you have looking at the chart, but you do not necessarily want to get all in right away. Buying in little bits and pieces is the easiest way to deal with gold, as gold markets can be extraordinarily volatile. One thing I do like about them is they do tend to move in one hundred dollar increments. Because of this, I will be looking to pick up value later on in the month. The alternate scenario of course is that the market turned around and takes off above the $1900 level, which would signify that the selling is over.