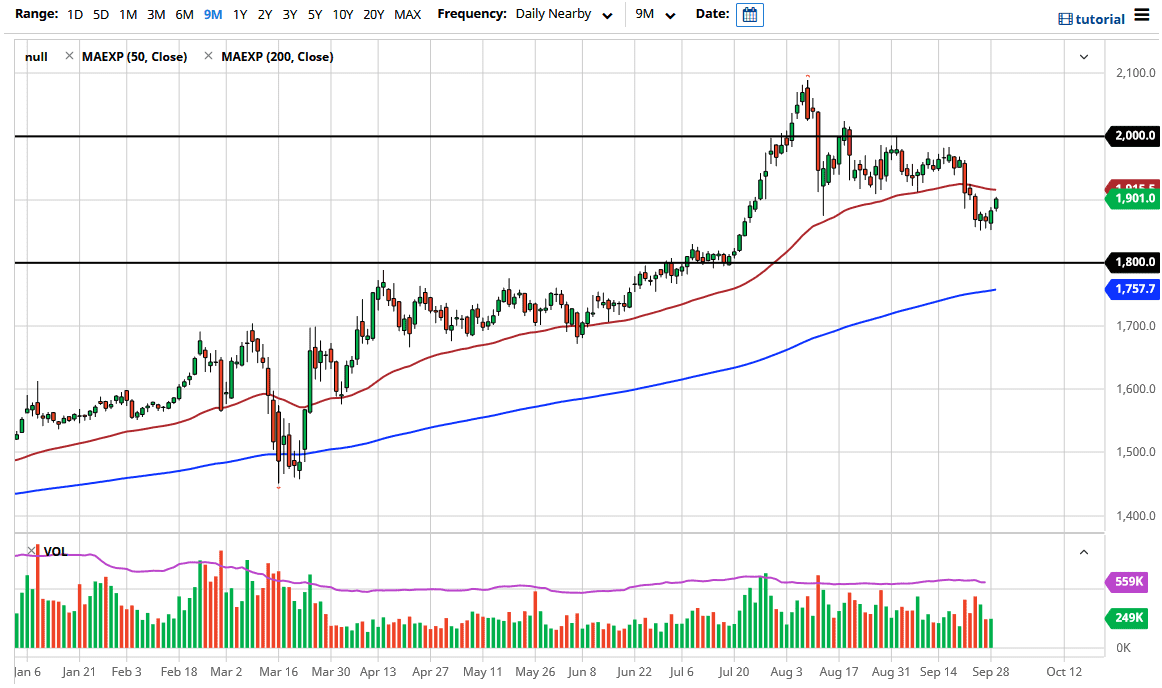

Gold markets gapped higher during the trading session on Tuesday and then went even higher than that. Ultimately, the market is testing the $1900 level, perhaps reaching towards the 50 day EMA above, which is currently at the $1915 level. That is an area that I think continues to be of interest, as the 50 day EMA has been so important in the past. At this point, I do believe that it is only a matter of time before we pull back, but that pullback should be a nice buying opportunity. For what it is worth, the $1850 level has offered support, but it is essentially short-term support more than anything else.

To the downside, the $1800 level would be significant as it was previous resistance, so at this point, I think it is only a matter of time before the buyers would jump in there as well. Pay attention to the US dollar, because if it starts to get sold off, we could very well see gold markets rally significantly. At this point, if we can break above the 50 day EMA then we could go looking towards the $1950 level. Breaking above their opens up the possibility of a move towards the $2000 level which attracts a lot of attention due to the fact that it is a large, round, psychologically significant figure.

I believe ultimately that the gold market does go much higher, and I do believe that we break above the $2000 level. Once we do, that will probably kick the uptrend into high gear, and ultimately this is a market that eventually will get there but obviously, we have a lot of work to do. The gold market will probably continue to be lifted by central banks around the world and the safety trade, so I think at this point it is simply a matter of finding value. Traders who got in at the $1850 level have in fact found a bit of value, but I think you will have multiple opportunities going forward. It is not until we break down below the 200 day EMA on a daily close that I would consider the uptrend in gold dead and gone. There are plenty of reasons to think that precious metals will continue to gain over the longer term, so a bit of patience can go long way.