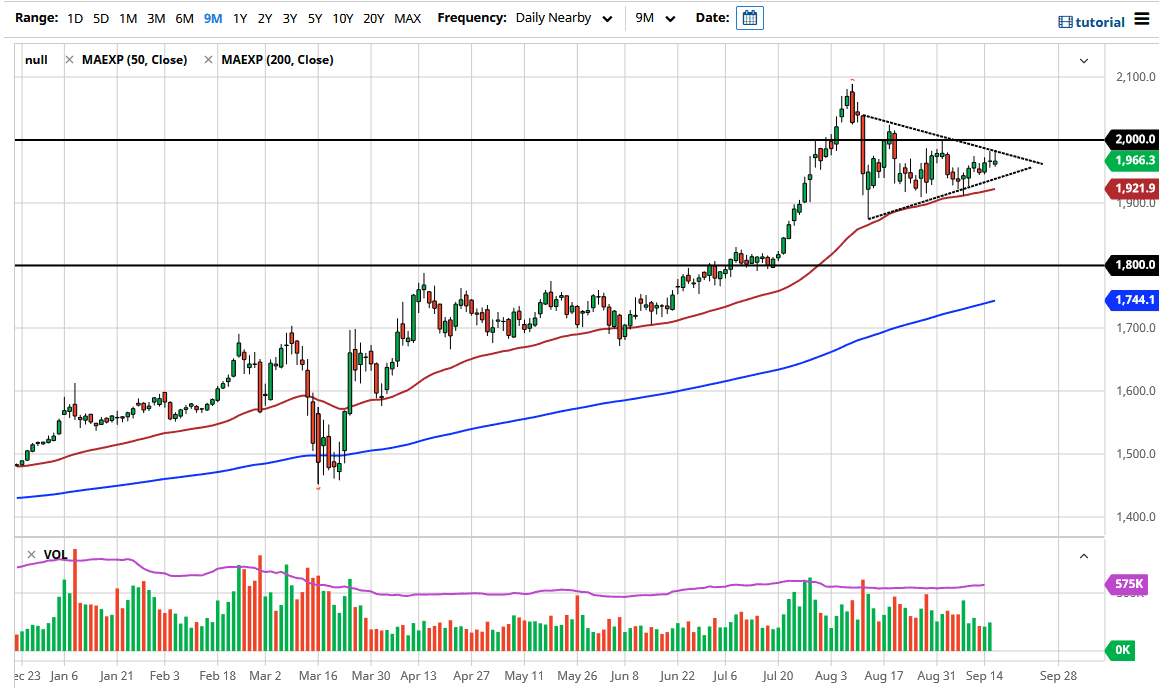

Gold markets have rallied again during the trading session on Wednesday but gave back the gains at the same downtrend line that makes up the triangle that I have drawn on the chart. As we continue to form shooting stars that suggest that perhaps the market is running out of steam, and with the US dollar picking up a bit of strength later in the day, that could continue to cause troubles. At this point, the market looks as if it is ready to go back and forth going forward, as the market is going to continue to be volatile. There are a lot of concerns out there when it comes to the global economy, so it does make sense that perhaps we would see the gold markets run towards if it is more of a safety play.

That being said, we may need to pull back a bit to test the bottom of the triangle. The 50 day EMA underneath is sloping higher and it is near the $1920 level. Furthermore, I think there is plenty of support at the $1900 level, which is a large, round, psychologically significant figure, and an area where we have seen buyers previously. Because of this, it would simply be a return to the buying area previously, so, therefore, it would make a certain amount of sense. Having said that, if we were to break down below the $1900 level, then we will go looking towards the $1800 level.

To the upside, if we were to break above the highs of the last couple of days, that would be a very bullish sign, perhaps sending the market towards the $2000 level. The $2000 level will be a major barrier to overcome, so if we do break above that, it is likely that the market will go rocketing higher. At that point, it is likely that we will go looking towards the $2100 level. All things being equal, this will move in a negative correlation to the US dollar. At this point, gold still remains in a very bullish trend, and as long as we can stay above the $1800 level, I think that remains the case. The 200 day EMA is starting to reach that level as well, so keep that in mind also as it tends to be very important for longer-term traders.