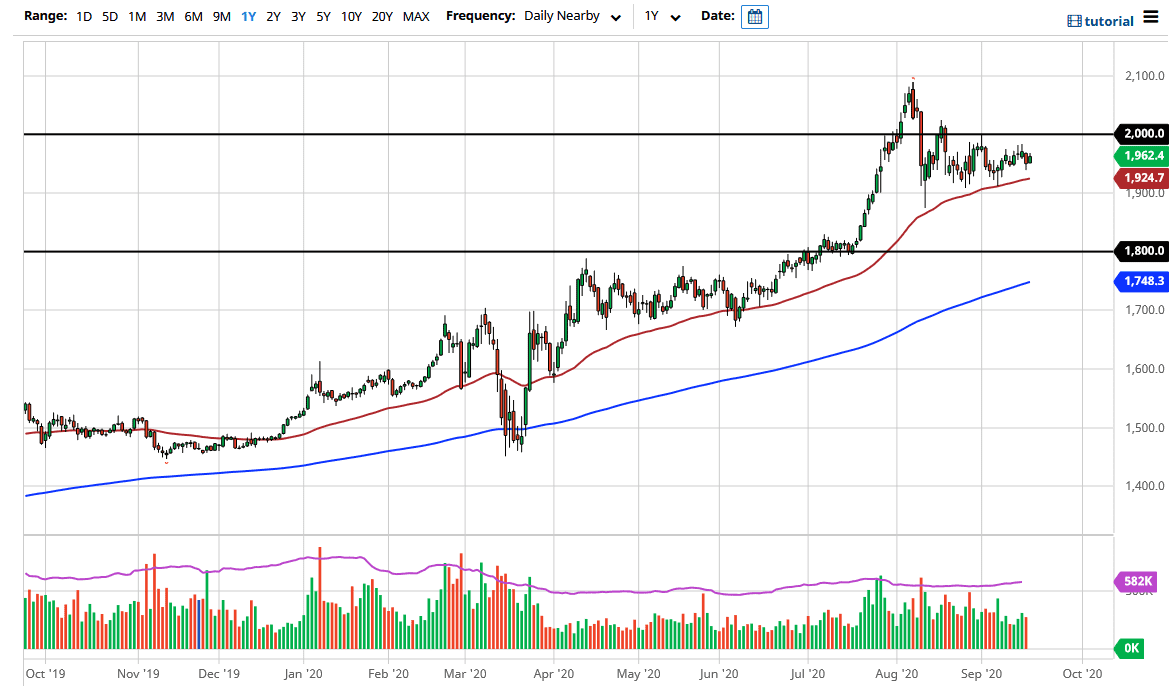

Gold markets went back and forth during the trading session on Friday again, as we simply drift sideways in general. Looking at the chart, the market has been losing volatility for some time, after shooting straight up in the air. At this point in time, it is likely that the market is going to go higher eventually, but we could see a pullback in the short term. I look at short-term pullbacks as an opportunity to pick up gold at a discount.

Underneath, the 50 day EMA should offer support, but even if it does not, the $1900 level will be an area that people will pay attention to. Looking at this chart, the $1900 level is an area that has been more than supportive in the past, so I think that continues to be the case. Even if that is the case, the market is breaking below the $1900 and does not necessarily have me selling this market, rather I would be looking for support underneath at the $1800 level. The $1800 level is an area that had previously been massive resistance, so I think at this point one would have to assume that there would be buyers in that area as well. Furthermore, the 200 day EMA is trying to reach towards that level, so I think we are looking at a longer-term “buy-and-hold” type of scenario.

On the other hand, if we can break above the $2000 level, then it is likely that we could go looking towards the $2100 level. That being the case, then it becomes the next leg higher, and it should continue to push gold to the upside. Central banks around the world continue to flood the markets with liquidity, so that typically will help the idea of precious metals going higher as it tends to devalue fiat currencies such as the Dollar, Euro, British pound, etc. Ultimately, this is a market that I think offers plenty of buying opportunities when gold becomes “on-sale”, so you need to pay attention whether or not gold is getting closer to the bottom of the overall trading range, closer to the $1900 level. On the other hand, if we were to break out then you simply need to go with the flow which has been most decidedly to the upside. I believe that at this point the market is simply building up pressure to reach even higher.