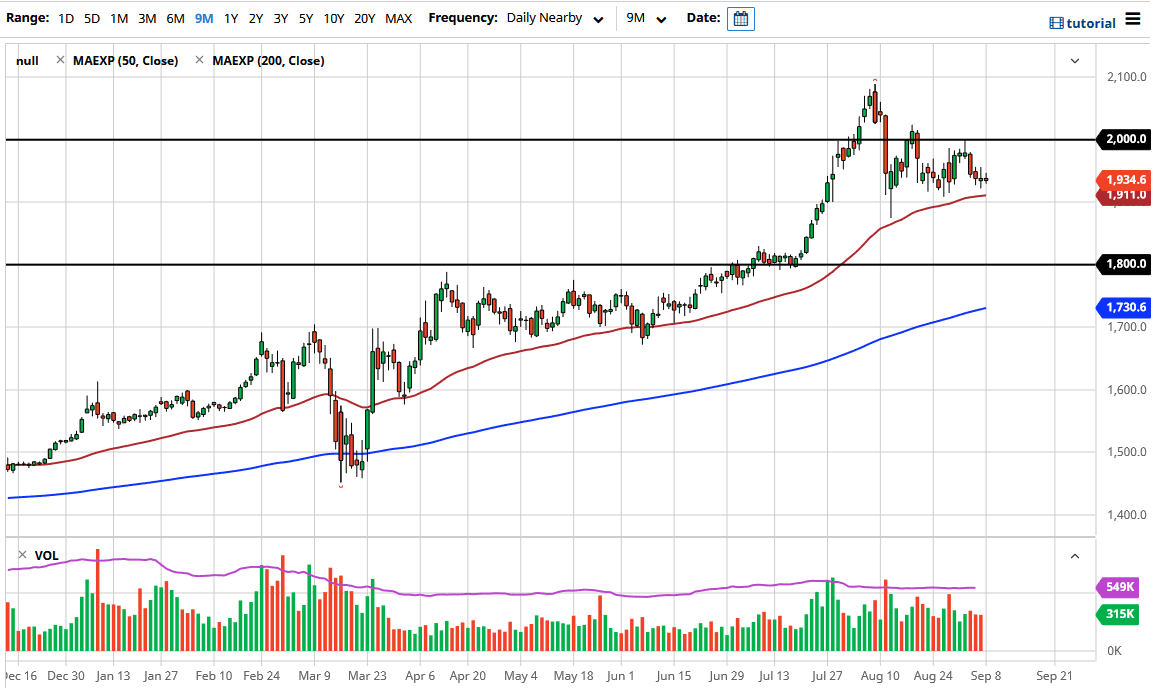

Gold markets have gone back and forth during the trading session on Monday, which would have had very thin volume due to the fact that it was Labor Day in the United States. With that in mind, the 50 day EMA underneath should offer significant support, and most certainly the $1900 level underneath should be. That is an area that I think should continue to offer plenty of support longer-term, but even if we break down below there, I think there are more than enough buyers near the $1800 level to keep this market afloat as well. After all, that was a significant breakout and therefore it should be significant support as market memory comes into play.

The Federal Reserve continues to do everything it can to loosen monetary policy and that will continue to drive the value of gold higher. It is not just the Federal Reserve though, central banks around the world continue to ease monetary policy so therefore gold is rising against most currencies. If you are looking for a coincident indicator, the US Dollar Index can off that move in an extremely negative correlation to this market, so keep that in mind.

To the upside, the $2000 level will more than likely cause significant issues, as it is a large, round, psychologically significant figure and an area where we have seen some selling pressure recently. That being the case though, I do think that we eventually break above there and that we are forming some type of rounded bottom or things along the lines of that should continue to push the market to the upside given enough time. After all, it is not only the monetary policy of central banks around the world to continue to push the gold markets higher, but it is a lot of “risk-off” type of scenarios that are out there as well. Remember, gold is also a safety currency, so with that in mind, it makes quite a bit of sense that the market continues to see a lot of “buy on the dips” as far as gold is concerned. As far as selling is concerned, I have no scenario in which I’m willing to sell gold at this point, so for me, it is just a question of whether or not I am flat.