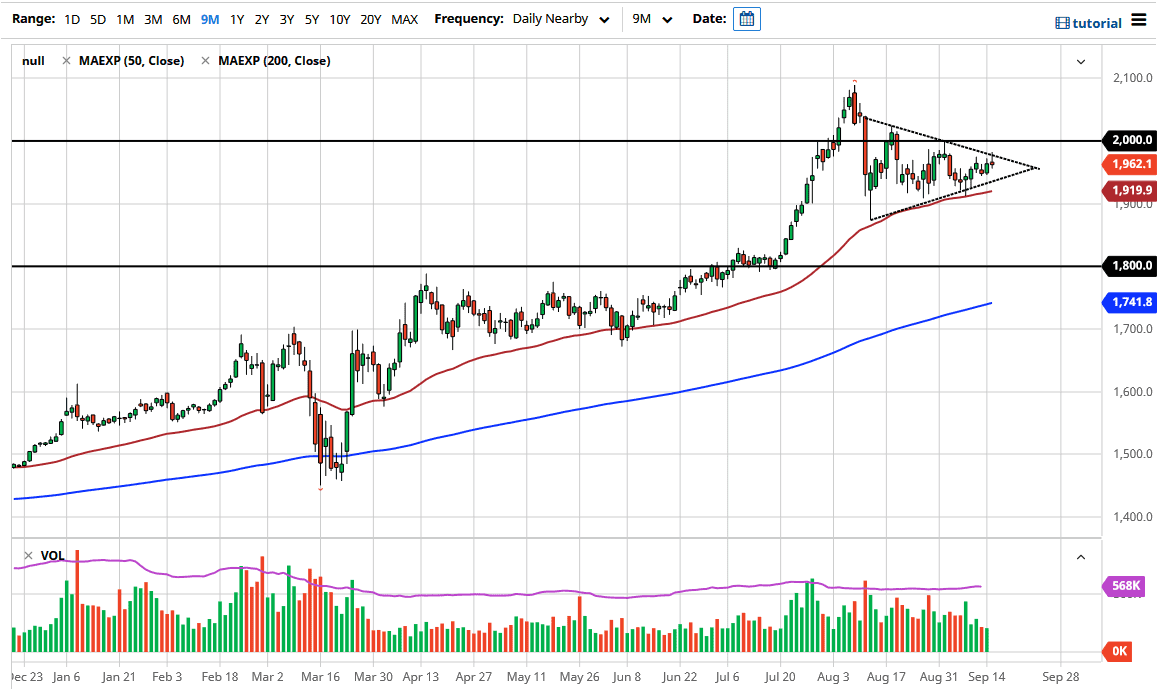

The gold markets out there continue to be stuck in a symmetrical triangle, as we tried to rally during the trading session but then fell back down on Tuesday. This is mainly driven by the fact that the US dollar has strengthened a bit, and by the end of the day we have ended up forming a bit of a shooting star. Ultimately, I think that this is a market that is likely to see plenty of buyers underneath that should be looking to pick up gold “on the cheap.” Having said that, if we find ourselves slipping into recession again, gold may actually break down a bit as the US dollar will strengthen. There are some concerns about that now.

To the downside, we have an uptrend line, but perhaps more clearly, we have the 50 day EMA sitting just below there as well. Both of those could cause a bit of support for the market, and I think it is only a matter of time before buyers would come in to pick up the bounce. If we were to break down below the 50 day EMA, then we would go testing the $1900 level underneath, which is a large, round, psychologically significant figure. By breaking down below there, then the market is likely to go looking towards the $1800 level, which is another large, round, psychologically significant figure, but perhaps even more importantly it is where we had broken out of previously. I believe that there will be a ton of buyers in that area, especially if the 200 day EMA catches up to that level as we get down there.

I think at this point the biggest thing that you need to pay attention to is the US dollar and how it is behaving. If the US dollar strengthens, that will work against the value of gold. That does not necessarily mean that we are going to sell off goal drastically, but it certainly works against it. If the US dollar starts falling rapidly as it had recently, then you can see gold rally rather significantly. Just above, the $2000 level course causes a lot of resistance, so a breakout above there would be an extraordinarily strong signal. Until then, I think we are probably looking at more back-and-forth trading going forward.