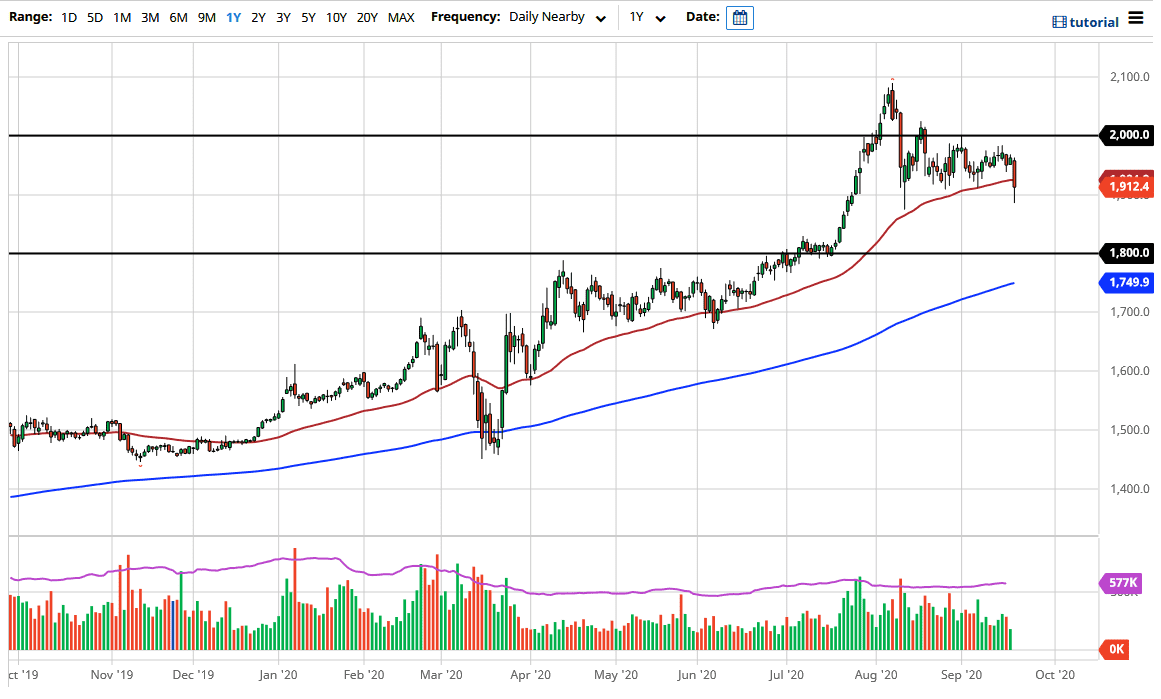

The gold markets broke down a bit during the trading session on Monday, reaching below the $1900 level. At this point in time, the market was testing a major support level, but we did recover a bit towards the end of the day. Ultimately, this is a market that has shown a certain amount of negativity, but we still have not broken through what I would call a trend defining support level.

The fact that we broke down below the 50 day EMA is a negative sign, and it does suggest that perhaps we could go lower. At this point in time, the market is likely to go looking towards the $1800 level, which I think it is much more important for gold. With this being the case, I would be watching this market break down below the bottom of the daily candlestick with interest, but I would also look at it as an opportunity to buy gold at lower pricing. I have no interest in shorting gold right now because the central banks around the world continue to flood the markets with this currency. The biggest problem that gold is dealing with right now is a strengthening US dollar. At this point, I would rather by the US dollar than short gold, which is essentially the same trade, something that is quite often missed by newer traders.

The $1749 level is where we have the 200 day EMA sitting, and that could reach towards the $1800 level above. That offers even more support as well, so this is another reason why I will definitely be interested in the $1800 level. If we were to break down below there, then things get a little bit more interesting but right now I am still looking for a buying opportunity. Ultimately, even if we do bounce from here, I would be a bit cautious until we get a daily close above the 50 day EMA. Furthermore, the market is likely to go looking towards the $2000 level, which is the longer-term resistance that now looks to be very difficult to get beyond. There is also the concern about risk appetite out there, so it is possible that we do eventually see a lot of Goldmine going forward. I think this is going to be a nice pullback, but I am not looking for the overall trend to change anytime soon.