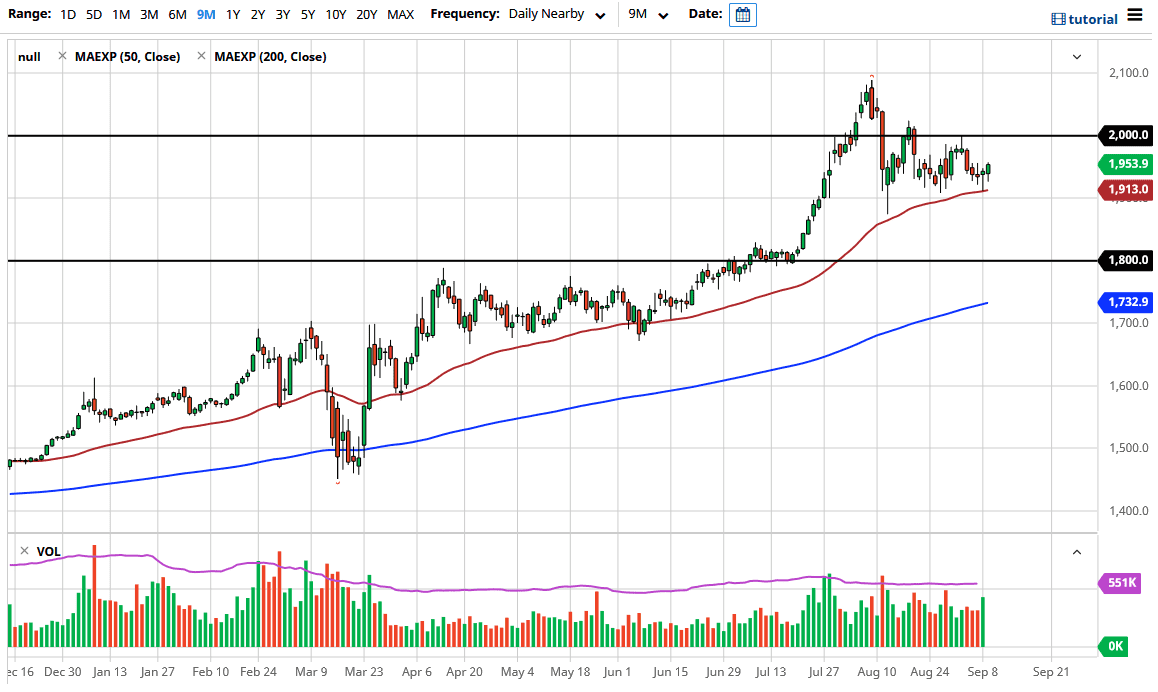

The gold markets initially pulled back a bit during the trading session on Wednesday but turned around to show signs of life again. That being the case, we ended up breaking above the top of the hammer from the previous session, which is a very strong sign. In fact, a lot of technical traders will look at that by itself as a signal to start buying. Nonetheless, what I find interesting is that the US dollar got hit rather hard during the trading session on Wednesday, while metals were the first place people ran towards. It looks like we are still looking at the US dollar as the main driver of precious metals, but we also have a lot of concern out there as well.

To the upside, the $2000 level above is likely to be targeted, which is an area that has been a massive resistance previously, and it is a large, round, psychologically significant figure. I find it difficult to imagine a scenario where we sliced through there right away, but eventually, we should see some type of push above that level if the US dollar does get hammered. If it does, then it is likely we go looking towards the $2100 level again.

To the downside, the 50 day EMA sits just above the $1900 level, which in that area I would anticipate seeing quite a bit of buying. Furthermore, it does look like currencies in the FX markets are trying to recover some losses against the US dollar, so that will continue to help. One of the easiest ways to look for that expression is the EUR/USD pair if you do not have the ability to follow the US Dollar Index. All things being equal, even if we do break down below the $1900 level, I think there is a massive amount of support at the $1800 level which was previous resistance, so therefore there should be quite a bit of “market memory.” If we were to break down below there, then I would start to worry about the longer-term trade. Until then, I am buying dips in this market more than anything else as gold has been such a great performer, and central banks around the world continue to loosen monetary policy.