For the second day in a row, the price of an ounce of gold is declining in light of the US dollar recovery, which pushed the price of the yellow metal towards $1927 ounce at the time of writing. Despite the drop, the metal is still in the range of a strong ascending channel. As global geopolitical tensions and concerns about the strength of the second Corona wave, and continued stimulus by global central banks and governments continue to support gold's gains. The yellow metal prices fell sharply yesterday with the rise of the dollar and the rise of stock markets on the back of somewhat optimistic data on factory orders and a recent report showing continued growth in manufacturing activity in the United States.

Data showing a much smaller-than-expected increase in employment growth in the US private sector in August had limited the decline in gold prices.

The dollar index, which fell to its lowest level in more than two years at 91.75 on Tuesday, rose to 92.87. Silver futures closed down by $1,250, or about 4.4%, at $27.39 an ounce, while copper futures were steady at $3.0205 a pound.

On the economic side, according to a report issued by the US Department of Commerce, new orders for US manufactured goods showed another big increase in July. The report said that factory orders rose 6.4% in July, matching the upwardly revised rise in June. Economists had expected factory orders to rise 6% compared to the 6.2% jump originally recorded for the previous month.

Factory orders continued to rise as durable goods orders increased 11.4% in July after rising 7.7% in June. And the demand for transportation equipment led to the rise. The Commerce Department also said that non-durable goods orders also rose 1.8% in July after jumping 5.3% in June.

According to data released by ADP payroll processor, employment in the US private sector increased by 428,000 jobs in August after rising by an upwardly revised 212,000 jobs in July. Economists had expected employment to jump by 950,000, compared to the addition of 167,000 jobs originally reported for the previous month.

On another level, a report from the Institute of Supply Management revealed that manufacturing activity in the US grew at the fastest rate in August. Accordingly, the ISM said that the PMI rose to a reading of 56.0 in August from a reading of 54.2 in July, and as is known, any reading above the 50 level indicates growth in manufacturing activity. Economists expected the index to reach 54.5 points.

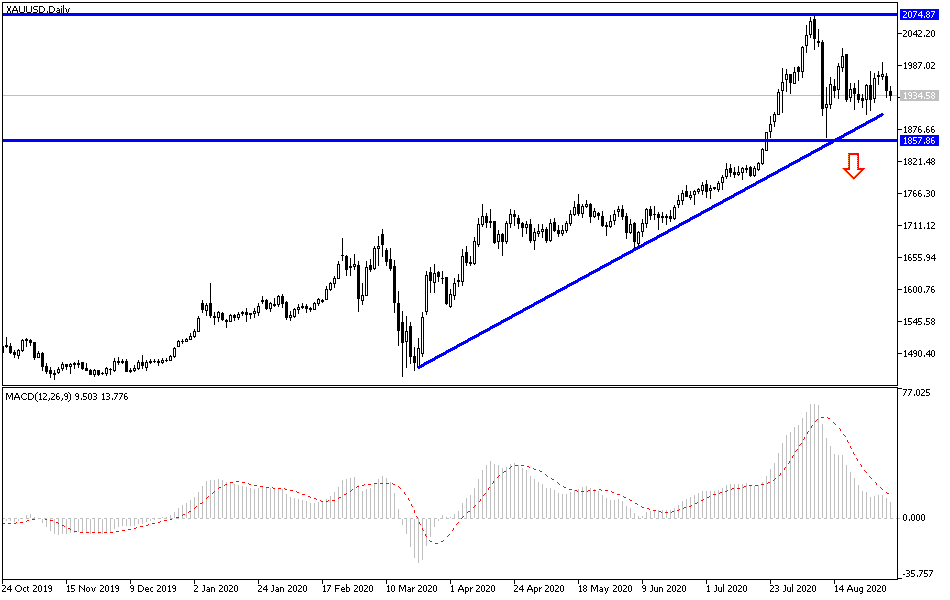

According to the technical analysis of gold: The current correction has not led so far to reverse the general trend of gold, which is still upward as long as it is stable above the $1900 resistance. I still expect the metal's gains to continue for a longer period, and therefore the resistance levels in 1955, 1980, and 2020 will remain the next targets for the bulls. According to the performance on the daily chart below, there will be no opportunity for the bears to control the performance without testing the support level of $1865 per ounce. As I mentioned above, factors of gold gain still present, and therefore any decline in prices will be an opportunity to start buying again.

Gold will interact today with the economic releases related to the services sector from the Eurozone, Britain, and the United States, and then the second and important statement for this week regarding the US labor market which is the jobless claims.