The collapse of the US currency and the continuation of global geopolitical tensions are still stronger catalysts for continuous gold gains reached the $1990 level at the time of writing, steps away from the $2000 psychological and historical resistance, and amid expectations that this level would be strongly surpassed if the current dollar’s performance continues. The dollar has become weak after Fed Chairman Jerome Powell outlined a change in accommodative monetary policy last week, which could lead to slightly higher inflation and lower interest rates for a longer period. The US dollar index, DXY, collapsed to the 91.99 support.

Silver futures closed higher at $28.60 an ounce, while copper futures settled at $3.0615 a pound.

Data from China is showing continued expansion of manufacturing activity in the country contributed slightly to the rise in the price of gold. The latest survey from the National Bureau of Statistics said that the Chinese Manufacturing PMI came at a reading of 51.0. This was below the expected score of 51.2 and below the 51.1 in July but is still fairly good. The non-manufacturing PMI came in at 55.2, beating expectations for a reading of 55.0. In July.

For global consumption, according to UBS Group, demand for gold jewelry and retail investment in India will drop to 350 from just 400 tons in the fiscal year 2021. The second-largest gold consumer is likely to face its worst recession ever due to the pandemic and consumption is unlikely to return to normal levels any time soon. UBS report says India consumed 633 tons in 2020.

On the other hand, De Beers, the largest producer of diamonds in the world, decided to reduce the price of its gemstones, hoping to increase sales amid a state of paralysis that affected the industry. Bloomberg has reported that De Beers has lowered the price of rough diamonds larger than 1 carat, a size that typically results in a polished 0.3-carat gem. Larger stones have been reduced by approximately 10 percent. The Russian diamond mining company Alrosa PJSC is also working to lower prices, but the billing system has changed so that buyers cannot know which stones are being discounted or by how much.

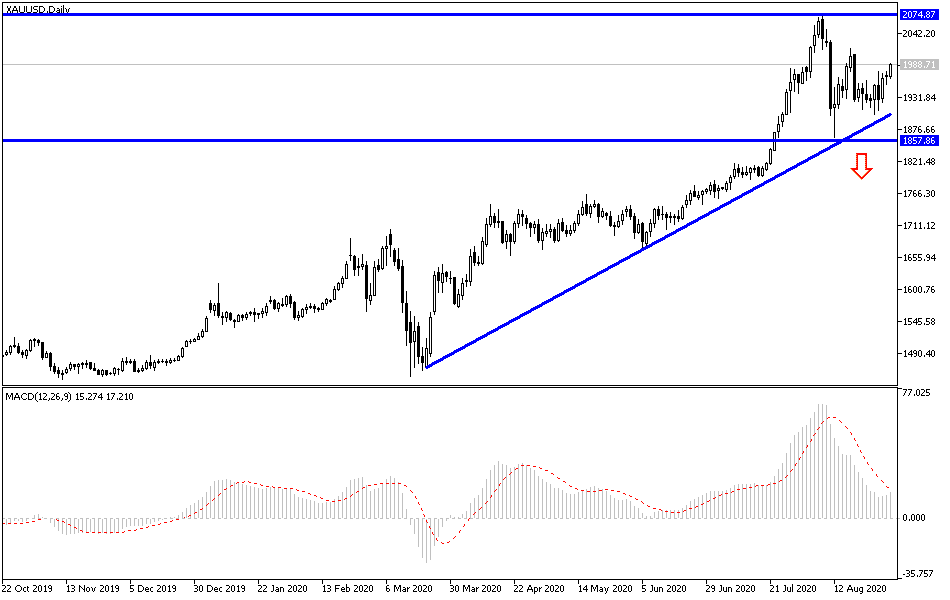

According to the technical analysis of gold: the bullish gold momentum is getting stronger in light of the continued weakness of the US dollar and the increase in global geopolitical tensions. Accordingly, the price of the yellow metal may move towards stronger bullish levels, with the closest being 2015, 2030, and 2100, respectively. There will be no real reversal of the current trend downwards without surpassing the 1900 support. All in all, I would still prefer buying gold at every drop. The metal will interact today with the release of the manufacturing PMI readings from China, the Eurozone, Britain, and the United States of America.