The bearish momentum for the gold price is still the strongest in light of the strong buying operations of the US dollar, which moves inversely with the path of gold prices. The price of gold fell to $1882 an ounce, its lowest in two months ago. Yesterday, it tried to rebound higher, but its gains did not exceed $1920 an ounce before it returned to stability around the $1900 an ounce at the beginning of today's trading, which contains more important economic issues affecting the morale of investors and financial markets. What stopped the losses of gold was the concern about the strength of the second COVID-19 wave, which threatens to restart the global economic activity lockdown again.

Some countries in Europe, including the United Kingdom and France, have announced new lockdown measures to curb the spread of Covid-19, and there is growing uncertainty over the pace of the economic recovery. The ongoing impasse over the new coronavirus relief package in the United States is also affecting investor sentiment. Investors were also absorbing speeches by Federal Reserve Chairman Jerome Powell and US Treasury Secretary Stephen Mnuchin.

Silver futures closed at $24.52 an ounce, while copper futures settled at $3.0610 a pound.

Speaking to the House Financial Services Committee yesterday, Tuesday, US Federal Reserve Governor Jerome Powell said that the way forward "will depend on keeping the virus under control, and on policy measures taken at all levels of government." He added that both employment and general economic activity were still well below pre-pandemic levels and that the way forward was still very uncertain.

On the other hand, US Treasury Secretary Stephen Mnuchin said that the White House continues to seek an agreement between both parties in Congress on another financial relief package.

Existing-home sales in the US increased to their highest level in nearly fourteen years during the month of August, according to a report issued by the National Association of Realtors. Accordingly, NAR said that sales of existing homes jumped 2.4% to an annual rate of 6.000 million in August after jumping by 24.7% to the rate of 5.860 million in July. The continued increase in sales matched economists' estimates.

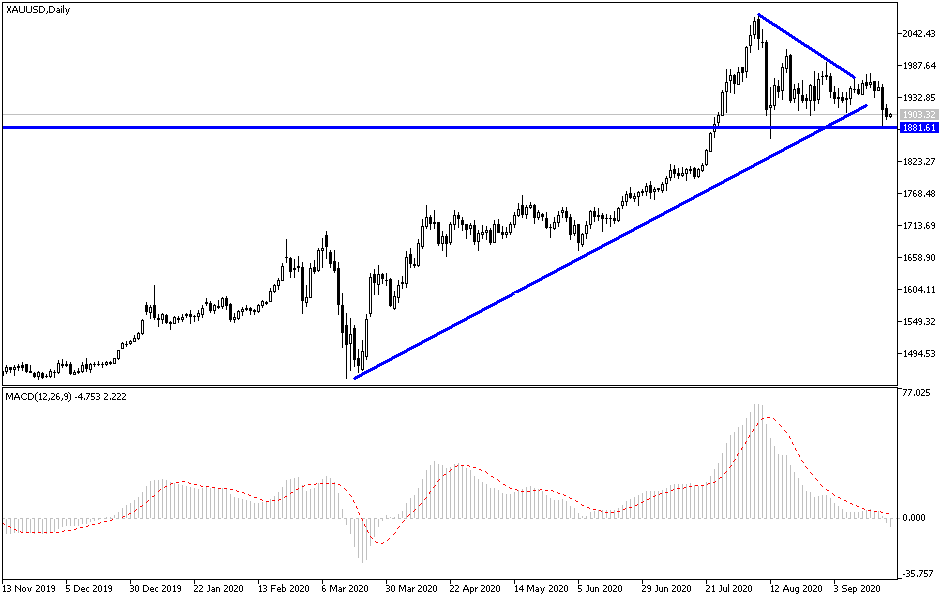

According to the technical analysis of gold: There is no doubt that the recent collapse of the gold price increases forex traders thinking about buying, as the yellow metal remains the traditional safe haven for investors in times of uncertainty, amid US/Chinese tensions, the bleak future of Brexit, the outbreak of the COVID-19 epidemic and its renewed threat to the global economy and the course of the US presidential elections. Accordingly, the support levels at 1884, 1873, and 1860, respectively, maybe the best suited to buy. Currently, technical indicators are giving strong oversold signs. In return, the bulls will not return to control performance without the gold price moving above the $1955 resistance again.

As for the economic calendar data today: The PMI readings for the manufacturing and services sectors will be announced for Australia, Britain, the Eurozone, and the United States of America. Then there will be an interaction with the content of Federal Reserve Governor Jerome Powell second testimony.