The strength of the US dollar contributed to the collapse of the gold price to $1849 at the beginning of the today’s trading session, to its lowest level in two months. The price of the yellow metal stabilized around $1855 per ounce, ahead of important statements by both Federal Reserve Governor Jerome Powell and the US Treasury Secretary. This is in a time when markets are anxious to announce any new stimulus plans for the US economy after the Congress failed to agree on it. More recently, Powell has faced intense questioning about the so far lacklustre success of another Fed emergency program, the Main Street Lending Program, which has made few loans to mid-sized businesses and their intended recipients.

He said that bank officials need to address many of the complexities in creating this program. He noted that the lack of demand for these loans showed that the private markets are now doing an effective job in providing loans to creditworthy companies. Powell's testimony this week comes as lawmakers oversee the government's response to the pandemic. On Thursday, US Central Bank Governor and Treasury Secretary Stephen Mnuchin will testify before the Senate Banking Committee.

And at last week's monetary policy meeting, the Fed kept its benchmark interest rate at a near zero level and indicated that it plans to keep it there through 2023. The central bank’s policy statement also reflected its new policy goal of allowing its preferred inflation gauge to exceed its inflation target rate of 2% for a while to compensate for the Fed's failure to meet this target over the past decade.

On a separate appearance on Thursday, Fed Vice Chairman Richard Clarida said in an interview with Bloomberg TV: “We're not even going to start thinking about a lift, as we'd expect, until we've noticed significant inflation - and we measure it year on year, equal to 2%.” "We can, in fact, maintain rates at this level even after that," he added.

"The economy is recovering strongly, but we are still in a deep hole," added Clarida.

On Wednesday, Powell was pressured by both Democrats and Republicans to support proposals to break the deadlock that prevented Congress from passing a new relief bill, including federal benefits for the unemployed, after the previous bailout package expired.

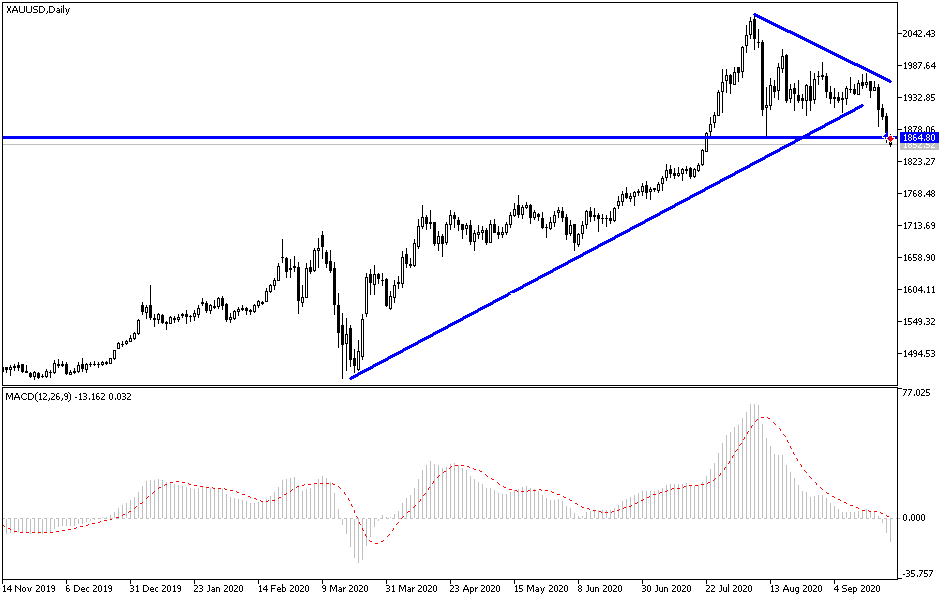

According to the technical analysis of gold: The recent sales operations contributed to gold forming a descending channel opposite to the movement of the metal throughout 2020, which is the most exciting year for gold investors, as it moved to a new historical and record top that exceeded $2000 an ounce, and the effects of the Coronavirus were the most important factor to achieve these gains. Despite the recent sales, the factors behind the return of record gold gains still exist, as the US-China conflict has not stopped, and the outbreak of the epidemic continues and may increase in the coming days, and stimulus on the part of global central banks and governments did not stop. US political anxiety is possible, and along with that is the bleak future of Brexit. Therefore, the support levels at 1849, 1838 and 1820, respectively, may be the most appropriate buying areas at present. I still prefer to buy gold from every lower level.