The yellow metal is trying to confirm that it is the best safe haven for investors despite recent selloffs. With the continuing global concern about the Coronavirus and the US/Chinese tensions and the absence of US economic stimulus and other things, gold investors currently prefer to gain from the expected bounce opportunities. Therefore, the price of gold has returned to $1888 an ounce, where it is settled around at the time of writing, awaiting new incentives to penetrate the important $1900 resistance again. The recent selling operations in light of the USD strength contributed to the decline in gold prices to $1849 per ounce, its lowest in more than two months.

At the global economic level, over the weekend, China reported that industrial profits in August rose 19% after rising 19.1% in July. During the first eight months of 2020, industrial profits in China were down 4.4% from a year ago. This underlines the weakness of the mining and equipment manufacturing sectors. The PMIs for September is due for release over the next couple of days. It should be noted that Chinese markets are closed for about a week starting from October 1st. Separately, the People's Bank of China (PBOC) set the reference rate for the dollar at 6.8252 CNY, which is slightly lower than what the banking models indicate. With the end of the quarter and the Golden Week holiday approaching, it threatens to inject volatility into the Chinese financial markets.

Also in the Asian area, there is some speculation that Japanese Prime Minister Suga is considering calling an extraordinary session at the end of October. This could delay previous financial efforts. Suga's strategy remains unclear. Some observers believe that early elections will be held, and then a supplementary budget. Japan will release industrial production and retail sales for August this week ahead of the Tankan Survey.

During the ongoing conflict between the United States of America and China, US courts hinder Trump's administration efforts to force TikTok to be sold and to shut down WeChat, the Trump administration has taken a fresh step to undermine Beijing's economic push. Export restrictions were imposed on the largest semiconductor maker, SMIC. Which has been discussed for several weeks and is therefore not surprising. The United States claims there is an unacceptable risk of using the military chip, although the company denies this. Reports indicate that Huawei has bought a fifth of SMIC semiconductors, and Qualcomm is using SMIC manufacture for some of its chips. This affects European producers such as ASML, who were unable to obtain a license to export to SMIC. Where it appears that there is some reservation in the implementation, but this represents a new escalation in the US-China confrontation.

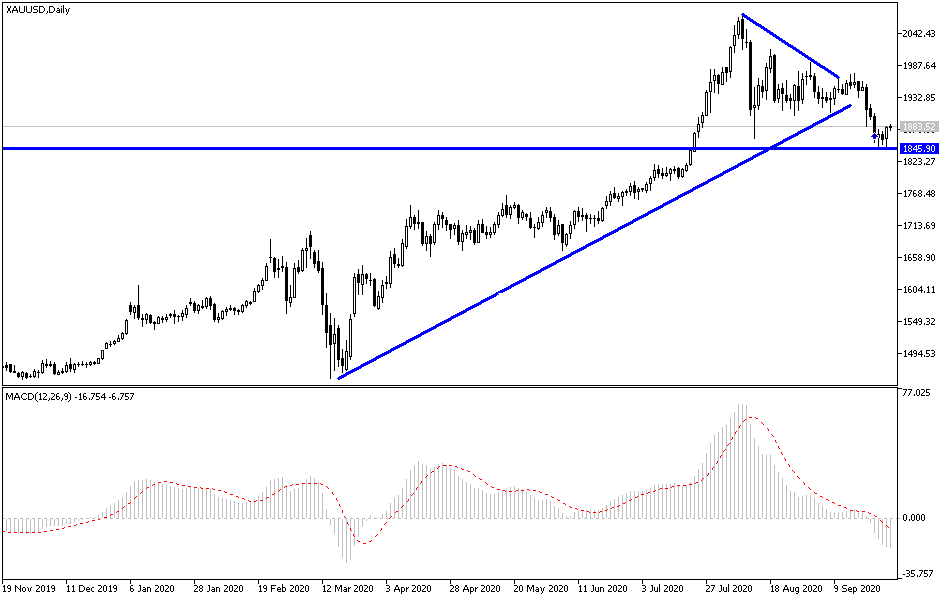

According to the technical analysis of gold: Bears control on the gold performance as shown on the daily chart below is still the strongest, and there will be opportunities for the bulls to return to control again if they move the prices to the resistance levels at 1900 and 1925, respectively, and from which gold buying may increase, and thus moving towards record levels again. According to the latest performance, breaching the $1850 support level will increase the bearish momentum, which is still in place.

Gold will interact today with the announcement of US consumer confidence and reaction from the comments of several members of the monetary policy from the US Central Bank. And the extent of investor risk appetite.