At the beginning of yesterday's trading session, the closest level to the historical $2000 resistance, the price of the yellow metal retreated towards the $1964 support before stabilizing around the $1972 level an ounce. The US dollar index DXY fell to 91.75 in the Asian session yesterday, Tuesday, reaching its lowest level in more than two years, before rising to 92.39 in the middle of yesterday's trading and settling around 92.32 at the time of writing.

Silver futures closed higher at $28,645 an ounce, while copper futures settled at $3.0285 a pound.

The US dollar recovered a lot after the Institute of Supply Management released a report showing that manufacturing activity in the US grew at a faster rate in August. Prior to that, the dollar suffered sharp losses late last week and early this week, affected by the Federal Reserve’s decision to change its monetary policy framework to allow inflation to rise above or below its 2%annual target for longer periods. Accordingly, the Fed governor stated that he may keep interest rates at low levels for a long time.

ActivTrades Senior Analyst Carlo Alberto De Casa wrote in a special report: “The Fed’s decisions and the new inflation target have opened the way for a new recovery in gold”. Gains in gold and other precious metals came even as the US stock market traded mostly higher in early September, a month historically weaker than others.

On the economic side, the ISM said that the PMI rose to a reading of 56.0 in August from 54.2 in July, and as it is known, any reading of the index above the 50 level indicates a growth in manufacturing activity. Economists had expected the index to reach 54.5 points.

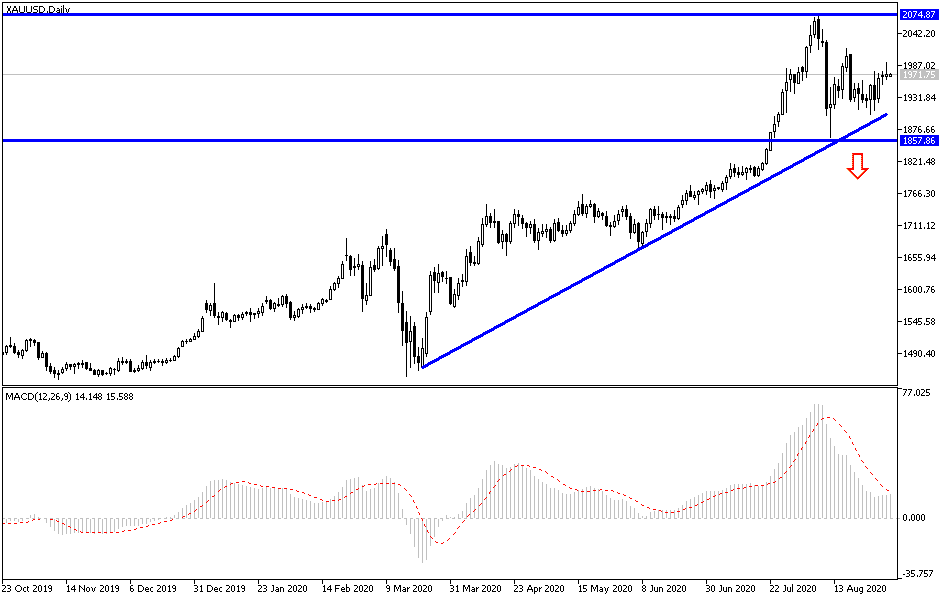

According to the technical analysis of gold: Despite the recent correction, the price of gold still has the opportunity to maintain its gains and even move towards stronger record levels. The tensions between the United States of America and China, the continued easing of the monetary policy of global central banks, the pressures on the dollar and the consequences of the COVID-19 epidemic on the global economy, are all are factors that motivate gold investors to buy from every descending level, and the closest support levels for the gold price today are 1960, 1938 and 1920, respectively. In return, Gold bulls are still waiting to break through the $2000 psychological resistance to push the metal towards stronger records.

Gold prices will interact today with the announcement of Australian economy growth rate and the ADP reading to measure the change in US non-farm sector employment. As well as statements of the Governor of the Bank of England and statements of some members of the Federal Reserve Board, commenting on Jerome Powell's recent announcement of changing the bank’s goals in order to revive the US economy.