The bulls tried to take advantage of the USD weakness and move the gold price higher, to reach the resistance at $1967 an ounce, to avoid a downward close during last week’s trading after profit-taking selling that pushed the gold price towards the support at $1907 an ounce. The week’s trading was closed around $1940 an ounce. The yellow metal still has the opportunity to achieve more gains in light of the continuing global geopolitical tensions and the expansion of global human and economic losses from the Coronavirus, as well as the bleak future of Brexit along with other factors that support investors' appetite for gold as a traditional safe haven.

A report by the US Labour Department showed that consumer prices in the US rose slightly more than expected in August. The report stated that the Consumer Price Index rose 0.4% in August after increasing by 0.6% for two months in a row. Economists had expected consumer prices to rise 0.3%. Excluding food and energy prices, core consumer prices were still up 0.4% in August after a 0.6% increase in July. Core consumer prices are expected to rise by 0.2%.

Last week, the European Central Bank did not change its position on its monetary policy, and at this meeting, Governor Lagarde played down the importance of the recent rise in the Euro. Talking about its 10% move is considered an exaggeration as it takes the Euro from its lowest level in late March, it remained steady throughout the year until the end of June. The Euro rose strongly in July but moved broadly higher in August.

Adding to the gains, the US Federal Reserve adopted an average inflation target. The European Central Bank expects fourth-quarter GDP growth of 3.1%, down from 3.2% in June. The forecast for the year was revised upward to show a contraction of 8% instead of 8.7%, mostly due to growth in the third quarter. Germany raised expectations this year. but trimmed next year (5% instead of 5.2%). All in all, the ECB does not appear to be too bothered by the loss of momentum in the survey data. Lagarde echoed Lynn's comment and said that the European Central Bank will "carefully watch" the impact of the Euro on inflation.

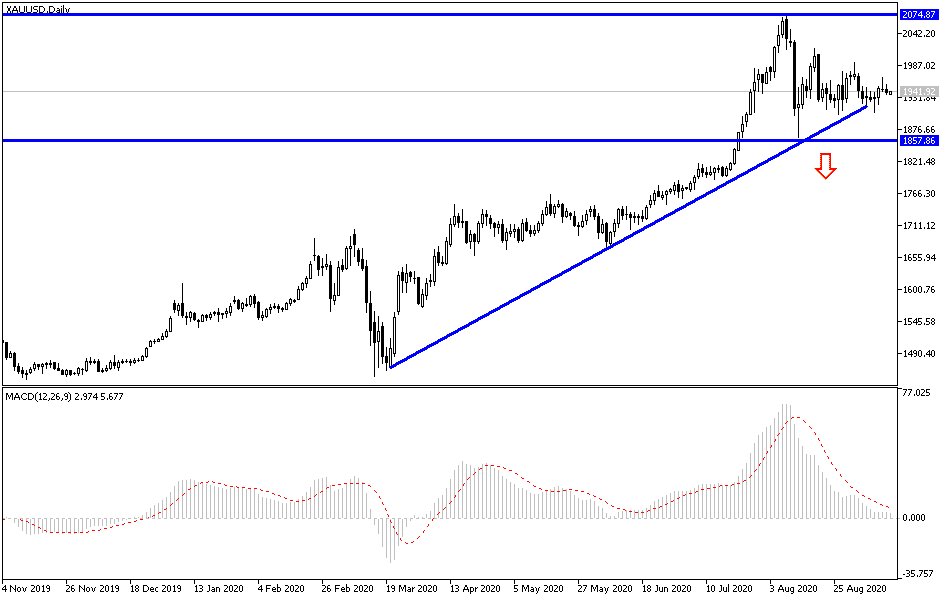

According to the technical analysis of gold: There is to my technical view of the price of gold, as the general trend will remain up as long as it is stable above the $1900 resistance. With the continuation and survival of the above-mentioned factors, gold bulls will still have complete control over the performance and are ready to push gold to higher levels, the closest of which are now at 1955, 1970, and 2000, respectively. There will be no real reversal of the current upward trend without the bears moving the price below the $1900 level. Quiet movements for gold are expected today in light of the absence of important and influential releases from the economic calendar, and investor’s risk appetite will have the most impact on the yellow metal.