For the second day in a row, the price of gold moves higher, bouncing back to the $1951 resistance. The strength of the US dollar and global stock markets was a decisive factor in the collapse of gold prices to $1907 an ounce on Tuesday. What stopped the losses of the yellow metal was the continuing global concern about the Coronavirus consequences, which is still reaping more human and economic losses around the world, as well as the continuing tensions between the two largest economies in the world and the concern about fierce competition in the US presidential elections next November.

Yesterday, US stocks rebounded as technology stocks rebounded after recent sharp setbacks, and most of the markets across Europe closed higher. The major US indexes; the Dow Jones, Nasdaq, and S&P 500, rose 2.4%, 3%, and 2.6%, respectively, and in contrast, the DXY dollar index, which moved from 93.66 to the 93.14 level, supported the return of gold's gains. Despite the rise in the equity markets, the appeal of gold as a safe haven has ensured price stability. Continuing uncertainty over the Brexit front also contributed to the rise in the price of the yellow metal.

At the same time, investors are looking forward to the monetary policy announcement from the European Central Bank today, Thursday, and any non-routine measures that may cause significant activity in the markets. Therefore, the price of gold will move according to investor sentiment about what will be announced. From the United States, talks to introduce more economic stimulus plans still face more obstacles. At the same time, stalemate is fraught with political risks for all parties heading to the fall elections that will determine not only the presidency but also control of the US Congress.

While coronavirus cases across the country appear to have reached a stage of stabilization, widespread economic hardship and social discomfort remain in the homes, schools, and businesses affected by the closures. Experts warn that infections are expected to rise again if Americans fail to adhere to public health guidelines of wearing masks and social distancing, especially with the cold weather and the flu season approaches.

In the midst of the dispute between the poles of US policy, the new weekly unemployment benefits of $300 will expire right after Christmas, on December 27. The lack of agreement will increase pressure on the US labor market.

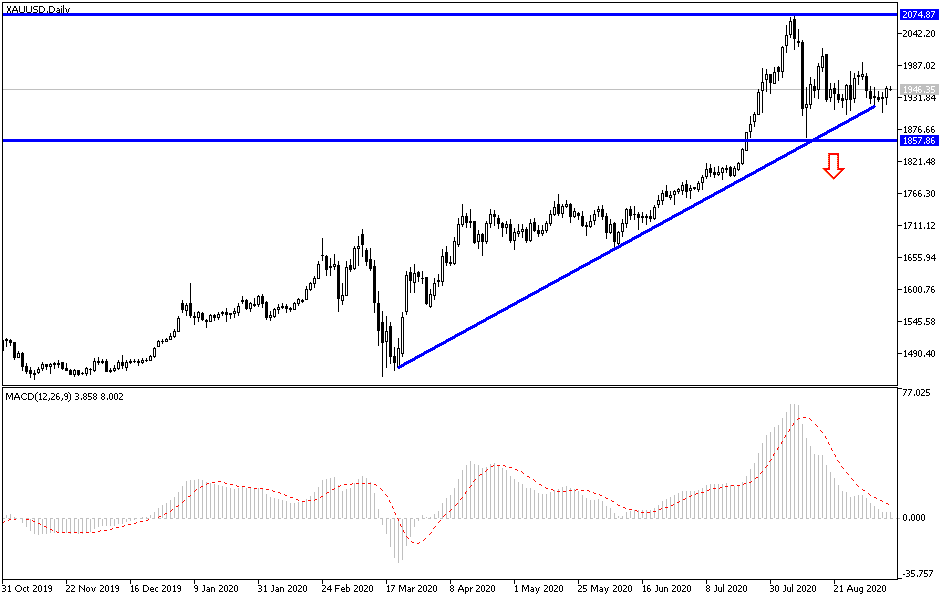

According to the technical analysis of gold: There is no change in my technical view towards the price of gold, as the general trend is still bullish as long as it is stable above the 1900 resistance, and after current gains, the bulls have gained control and they have the opportunity now to move towards higher resistance levels, the closest of which are currently 1963, 1980, and 2010, respectively. In general, I still prefer to buy gold from every lower level and the closest ones are now 1937, 1920, and 1900, respectively. Whereas, the continuously troubled relations between the United States of America and China, and the devastating effects of the Coronavirus will remain constant factors to support gold gains for a longer period.

The gold price will interact today with the European Central Bank's monetary policy announcement, as well as the results of US data, namely jobless claims and the producer price index reading.