Gold price received the meetings of international central banks (the Bank of Japan, the Bank of England and the US Federal Reserve), with a gain of 1% at the beginning of this week's trading. Accordingly, gold prices moved towards $1963 an ounce before stabilizing around $1955 at the time of writing. Gold prices have also received support from the weak US dollar, which is driven by expectations that the US government will soon approve another billions of dollars in stimulus and relief package to counter the consequences of the COVID-19 pandemic. In general, the yellow metal recorded tepid weekly gains last week, bringing its rise since the start of 2020 to date to nearly 30%.

In the same performance, the price of an ounce of silver, the sister commodity to gold, rose to $27.35 an ounce. The white metal also saw a good week, as it rose around 1%. Since the beginning of the year 2020 to date, prices have increased by more than 52%.

Today, the US central bank begins the two-day meeting of the Federal Open Market Committee (FOMC) for September. While it is widely expected to leave interest rates near zero, the Fed is expected to provide more details surrounding its new inflation approach. And last month, Fed Chairman Jerome Powell announced that the Eckles Building would allow inflation above the 2% target rate, leaving rates low for a longer period.

Global financial markets are also awaiting monetary policy announcements from the Bank of England (BoE) and Bank of Japan (BoJ) later this week.

US Treasury Secretary Stephen Mnuchin recently stated that "now is not the time" to worry about the $3.3 trillion budget deficit and the $27 trillion national debt. Mnuchin may have hinted that the Republicans and Democrats may soon reach another stimulus agreement, a deal that would put inflationary pressure on the US dollar and raise the price of metals such as gold.

With these two developments now, the US currency is reversing its gains over the past two weeks. Accordingly, the US dollar index, which measures the performance of the greenback against a basket of six major currencies, declined 0.3% to 93.05, from an opening at 93.29. The index gave up weekly gains but is still down 3.5% from the beginning of 2020 to date. The depreciation of the US currency is a good thing for dollar-denominated commodities because it increases the cost of purchasing them for foreign investors.

Regarding other metals markets, copper futures rose to $3.0655 a pound. Platinum futures rose 1.91%, to $957.50 an ounce. Palladium futures fell to $2,324.10 an ounce.

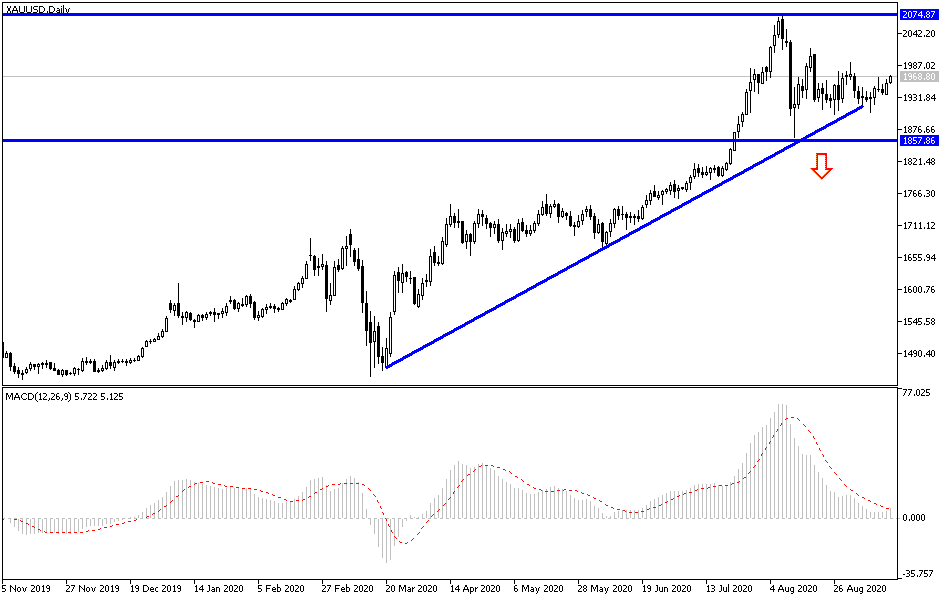

According to the technical analysis of gold: As was the recent expectations, the price of gold is still maintaining its upward momentum as long as it is stable above the $1900 resistance. Gain factors are still present and strengthening, which increases the investors' appetite for the yellow metal as a safe haven. These factors are global geopolitical tensions, especially between China and the United States, as well as the continuing failure of Brexit negotiations, the persistence of the Coronavirus and its continuing impact on the global economy, and the continuous stimulus by global governments and central banks. The closest bulls’ targets are now 1966, 1980 and 2010 dollars, respectively. The first chance for a reversal of the current trend is to break below the $1900 level.