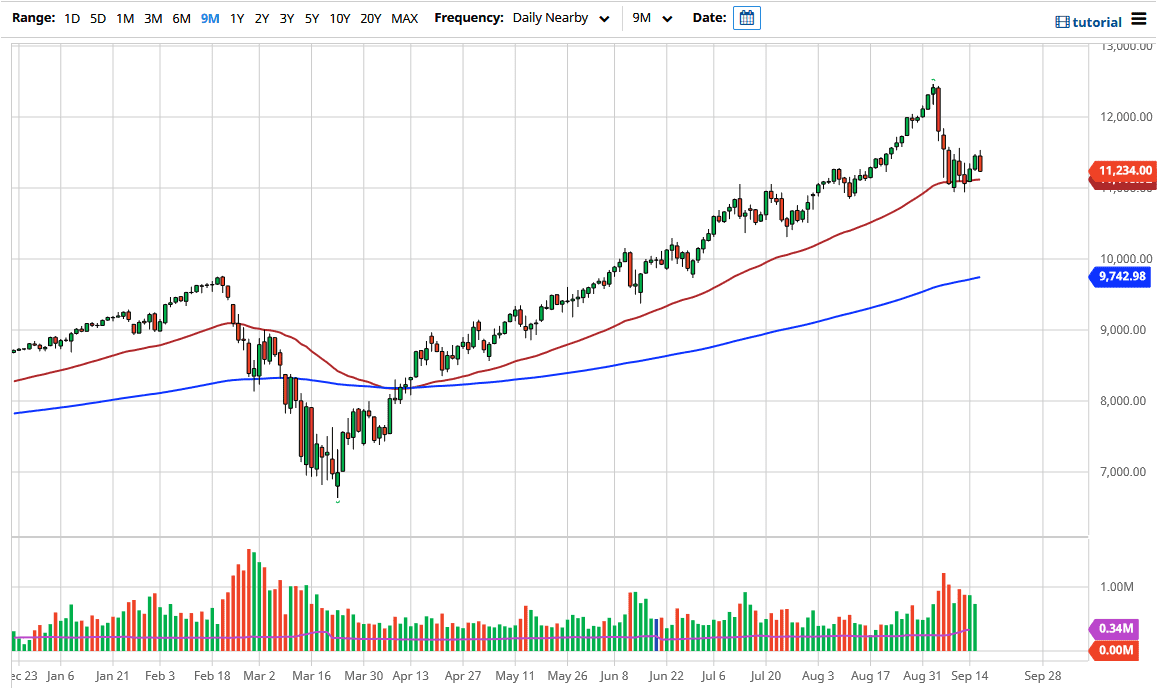

The NASDAQ 100 has initially tried to rally during the trading session on Wednesday but then broke down rather significantly throughout the day as technology stocks continue to suffer. Ultimately, the Federal Reserve statement and the question and answer portion of the day from Jerome Powell did not help either. At this point in time, the market is likely to see a lot of negativity out there, but if we were to break down below the 11,000 level, then we could break down significantly.

Underneath the 11,000 level, the market is likely to go looking towards the 10,500 level, followed by the 10,000 level. I believe that buying some type of breakdown is probably what we are going to be looking to do given enough time, but we do not have the signal to do so right here. Ultimately, shorting this market is impossible as well because there is obviously some support underneath. All things being equal, the market is likely to see a lot of volatility, and it should be noted that the VXN, a measure of volatility in the NASDAQ is starting to rise again. That is a negative sign.

If we can break above the 11,600 level, then it is likely that the market will go looking towards the 12,000 level, perhaps even 12,500 which was the high. Right now, it appears that the markets are sorely reacting to what the US dollar is doing, as we have seen an extremely negative correlation between the value of the greenback and stocks. With this, I would be very cautious about this market and wait to see whether we break up or break down before putting any type of money into the situation. We have been in a long-term uptrend for quite some time, but I think it is easier to buy a dip than it is to try to sell this market, even if we do break down a bit. After all, it is always the same five or six stocks that move the NASDAQ 100, and those of the same six stocks that everybody loves. Because of this, I prefer to short the Russell 2000 if this market breaks down because it is not supported by all of the Wall Street darlings that have lifted the indices for some time.