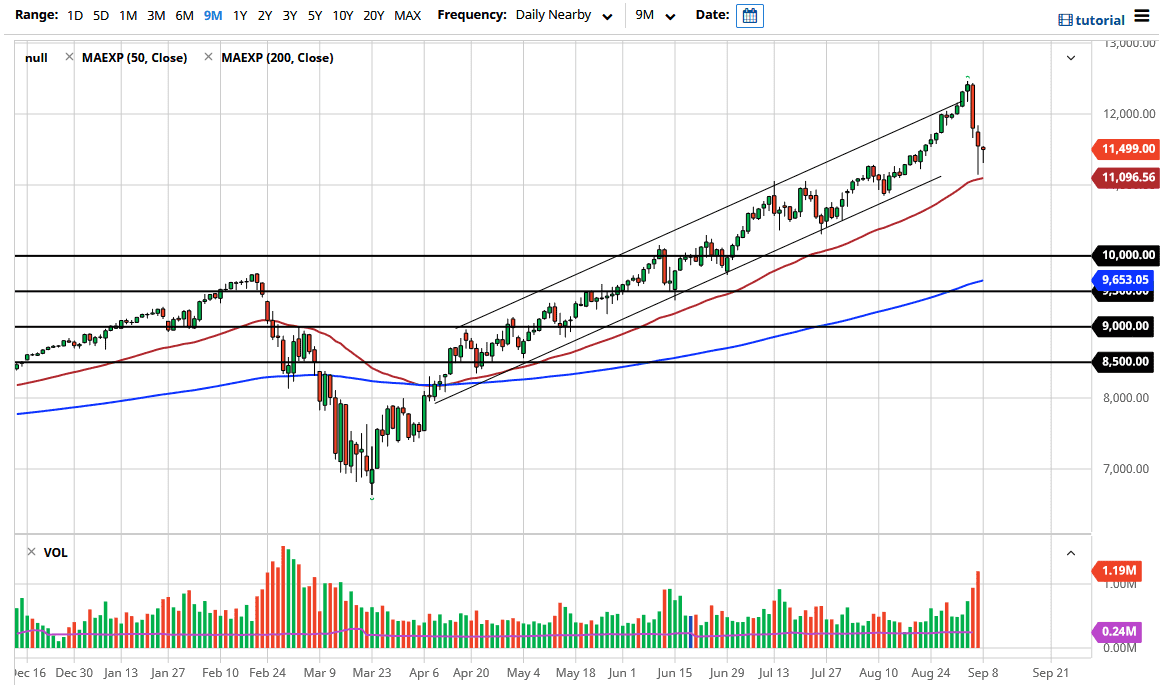

The NASDAQ 100, at least the electronic session, showed signs of support yet again near the 11,500 level, as the Americans were away at Labor Day. That being said, we are very much in an uptrend, so it does make quite a bit of sense that there would be buyers in this general vicinity, as it is the bottom of the overall up trending channel that we had been in, and the scene of the 50 day EMA which attracts a lot of attention as well.

The fact that we are forming a bit of a hammer during the Monday session shows that we still have plenty of support underneath. The hammer from the Friday session was rather impressive, and therefore it looks as if there is at least some attempt to keep the market somewhat afloat. The question at this point is whether or not the market can continue the upward momentum that we have seen, especially as there are a lot of questions when it comes to Softbank manipulating the options market to drive up the underlying indices. That being said, as a technician you simply look at the momentum of the market and follow right along. As long as we can stay above the 11,000 level it is likely that the market will continue to go higher and be supported. If we were to break down below that level, then it is likely that the market could go down to the 10,500 level, followed by the 10,000 level which has a massive psychological component built in, and the 200 day EMA reaching towards that level.

All things being equal, this is a market that I think does continue to go higher, if for no other reason than the Federal Reserve throwing money into the markets. Do not get me wrong, I think that we had gotten ahead of ourselves but the last couple of days have done a massive amount of technical damage to the market. This is why I believe that if we do continue to go higher is going to be more of a grind than anything else. That actually is much better than the significant volatility that has been such a major factor in the market, as it is much more sustainable. With this, I still look to the upside, but I recognize that we may have further to go before we recover completely.