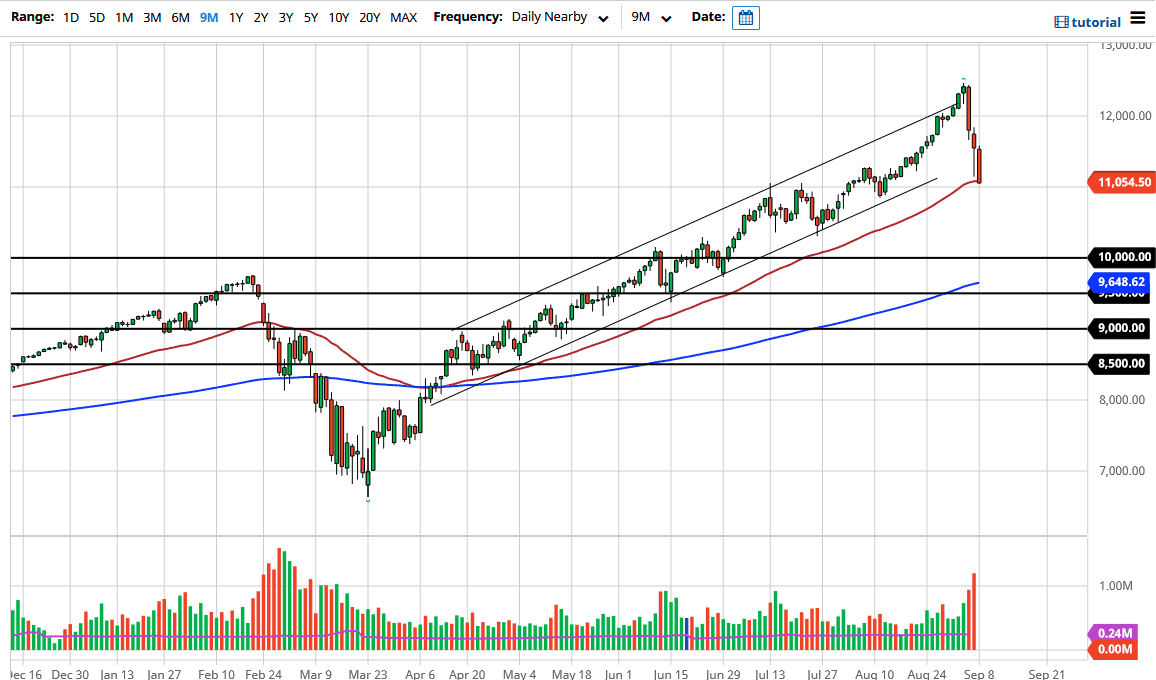

The NASDAQ 100 has broken down significantly during the trading session on Tuesday, cranking below the 50 day EMA, and testing near the 11,000 handle. At this point, the 11,000 level needs to hold, but if we do break down below there, then the NASDAQ 100 will unwind even further. This has been a very frothy market, and the fact that it just a handful of stocks have been lifting this market tells you that there are a lot of concerns. I have been paying attention to volatility, which was picking up before all of this started, so fractal math suggests that we should have sold off.

Another thing that is concerning me is the fact that we are closing at the very bottom of the candlestick, which is almost always a very negative sign. In fact, we have formed a hammer during the previous session which suggests that we could have a bit of recovery. However, we break down below the bottom of a hammer it is a very negative sign because that means everybody that had bought the NASDAQ 100 during the previous session is now underwater and will more than likely have to cover their buying position. With this, I suspect that the odds favor that the market breaks down, and short-term rallies will probably be sold into.

If we take out the candlestick from the trading session on Tuesday that will show an extraordinarily resilient market that is ready to go much higher. I do not think that is the base case scenario here, but it is worth pointing out that there is always the other possibility. I think we still have further to go to the downside, and the fact that we could not rally at the end of the day or even after hours in the futures market suggests that things are about to get even uglier, and this is a market that has desperately needed a pullback for some time. Unfortunately, the environment that we live in now is one that every time we pull back it has to be brutal. That being said, if you are a longer-term trader you need to be looking at buying opportunities and recognize the fact that the indices out there are not equally weighted, so it is all a matter of just a handful of stocks.