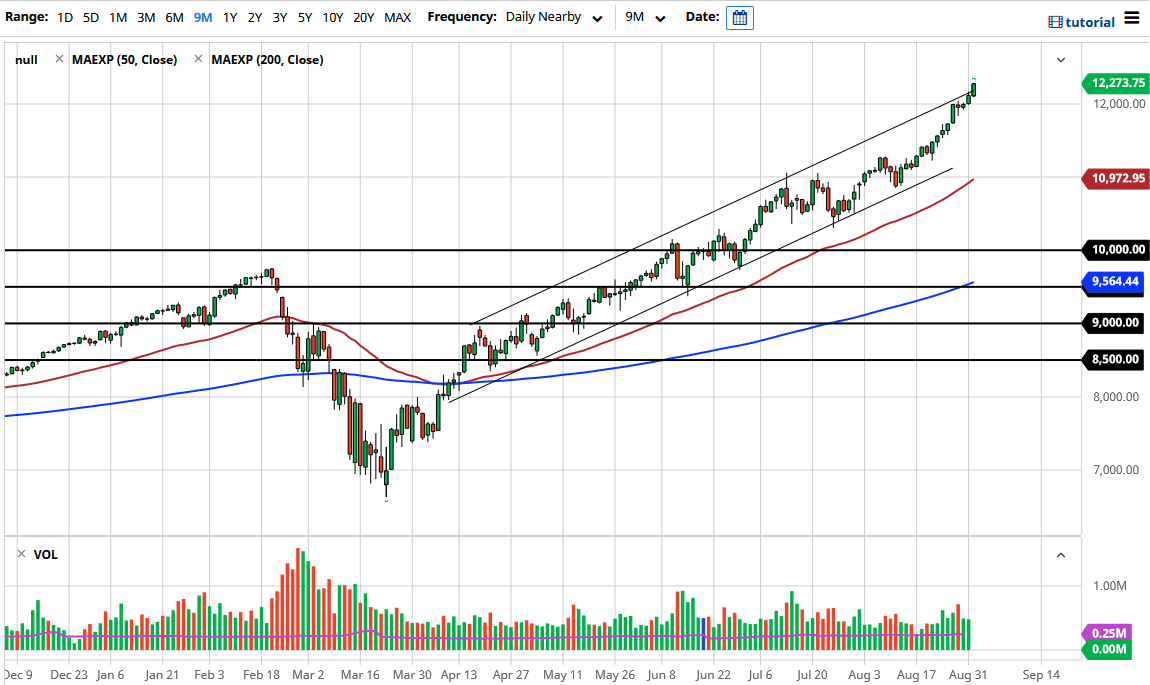

The NASDAQ 100 has rallied rather significantly during the trading session on Tuesday, slicing through the top of the Monday candlestick and perhaps even more importantly the top of an uptrend and channel that has been crucial for quite some time. The fact that we are closing towards the top of the candlestick also suggests that we will continue to a higher, but one thing is for sure, this is a market that is starting to get overdone, and you need to be very cautious about jumping in with both feet right now. That being said, the Federal Reserve will continue to show a lot of support for the markets, as we pressure the central bank to do something. Ultimately, the 12,000 level is an area that should continue to attract a lot of attention, but even if we break down below there, we should see plenty of support levels offer themselves as a possibility for the market.

Although we are breaking out of the channel, I am not as optimistic as you might think. Yes, I recognize that the market will probably shoot higher, but we also will probably get some type of significant pullback. It could even be on Friday after the jobs number comes out because that does tend to cause a lot of volatility anyway. Pay attention to the US dollar, because while the NASDAQ 100 was rallying late in the day, the US dollar was as well. Typically, it works in the other direction, so at this point in time, it is likely that we will have to see some type of resolution to that correlation.

I do believe that the 12,000 level is going to be supportive, but if we do break down below it then it is simply going to stand on the sidelines and let the market catch itself before getting involved. You will notice that I have not mentioned shorting the market because I think that is a suicide mission. Every time one of my friends or pundits suggest that they are going to short this market, they end up blowing massive amounts of trading capital on that idea. Following the trend is without a doubt the easiest way to trade the markets, and that is not going to be any different here either. Keep in mind that the NASDAQ 100 is driven by a handful of stocks, and everybody still loves those stocks.