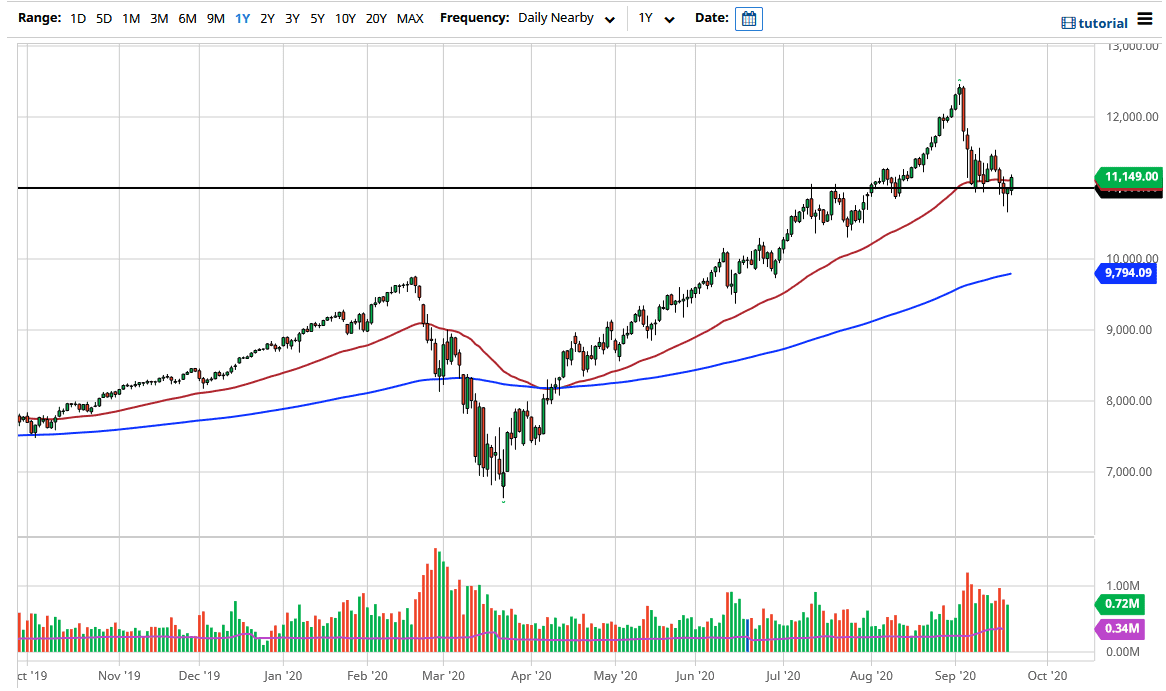

The NASDAQ 100 initially fell a little bit during the trading session on Tuesday but have turned around to show signs of strength. This follows a couple of hammers, so this is a very strong sign that perhaps the NASDAQ 100 is ready to go higher. With that being the case, the market is likely to look at pullbacks as a buying opportunity, and at this point, I think you would be very hard-pressed to be a seller of the NASDAQ 100 due to the fact that we have recovered so much.

If we can break above the highs of the trading session on Tuesday, it is likely that we would go looking towards the 11,550 level, where we had seen a lot of resistance in the past. At this point, it looks like a lot of the favorite stocks out there will continue to attract money, including Netflix, Apple, and the like. If that is going to be the case, then it is very likely that the NASDAQ 100 will get a bit of a bid. The fact that we are holding the 50 day EMA is a good sign, and the fact that we are holding the 11,000 level also helps.

If we were to break down below the hammer from the Monday session, that would be an extraordinarily negative sign, but as I have stated more than once, the reality is that the NASDAQ 100 is not built to be shorted, because it is not anywhere near equally weighted, and favors a handful of stocks that everybody on Wall Street buys. As long as that is going to be the case, then the only thing you can do is either by the NASDAQ 100, or step to the sidelines. If we do break down from here, then I think there is even more support underneath at the 10,000 level, not only due to the fact that it is a large, round, psychologically significant figure, but it is also where the 200 day EMA is sitting at, an area that a lot of longer-term technical traders will be paying attention to. The recovery has been quite impressive over the last 48 hours, so keep that in mind. I do not know that we will necessarily reach the highs right away, but it certainly looks as if we are in the midst of trying to have a short-term bounce.