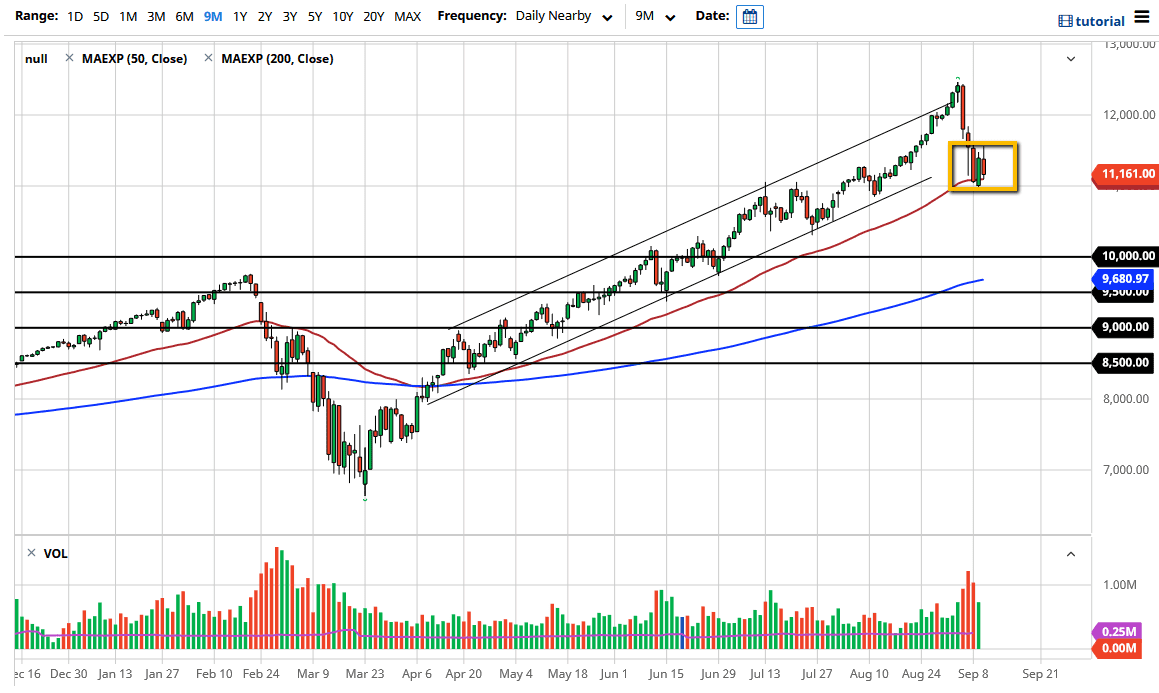

The market rallied significantly to kick off the trading session on Thursday, then turned right around to show signs of weakness yet again. This tells you that the market is very precarious right now, as we dance around the 11,000 level. I think Friday is going to be a very important session, because if we stabilize through the day and close with a reasonably positive or neutral candlestick, that could give you a bit of a “heads up” that traders are willing to stick with these technology stocks for a longer move. After all, depending on what happens over the weekend, you could wake up on Monday to see a major gap.

If the market breaks down below the 11,000 handle, then it is likely that the market goes down towards the 10,500 level, possibly even the 10,000 level after that. That being said, if we were to break above the top of the candlestick for the trading session on Thursday, that would be a very bullish sign and could send this market looking towards the 12,000 level. At this point, we are trying to figure out whether or not this has been a simple pullback, or if it is the beginning of something bigger.

The choppiness that we have seen will continue to be a major issue, as the market will continue to worry about global growth, the US dollar, and of course concerns when it comes to political risk as well, as Trump has been saber rattling with the Chinese yet again. This of course has a major effect on technology related stocks in general, so that is something that should be paid close attention to. Nonetheless, this is a market that continues to see headlines causing issues, and of course momentum being a major issue. The question now is whether or not all of that gamma squeezing from Softbank has led to a more permanent underpinning of weakness, or if we have finally cleared all of those issues. In other words, be very cautious with your position size, because quite frankly we could see a turnaround in the flash of an eye. This is a market that continues to be very noisy and difficult.