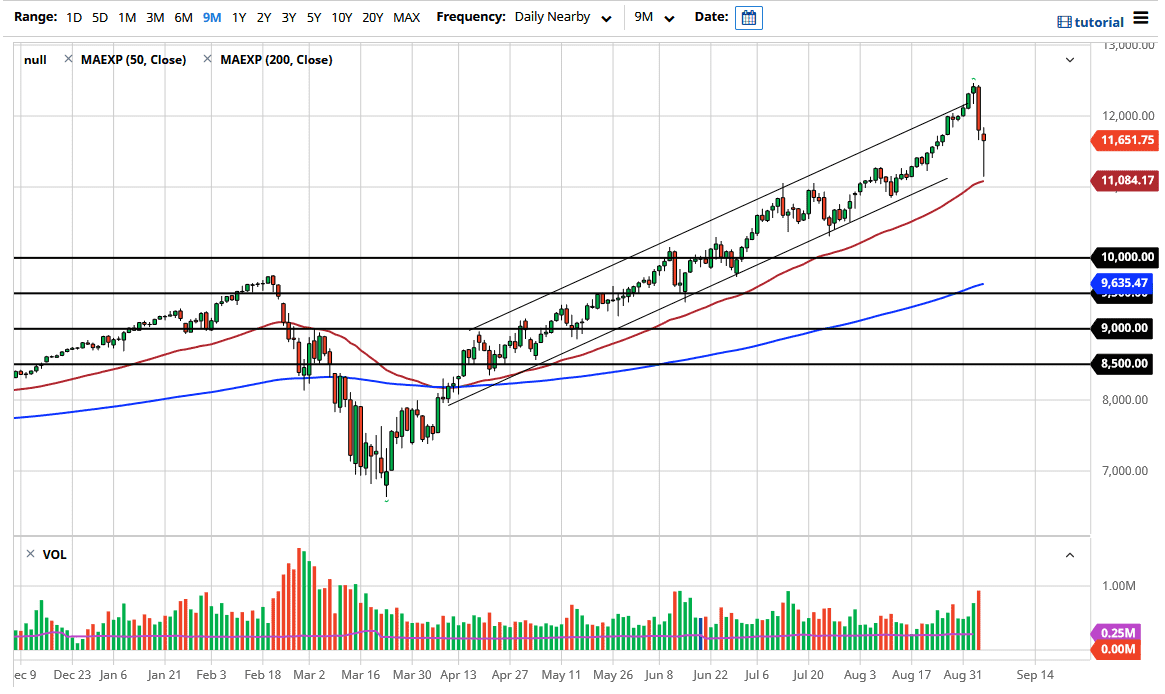

The NASDAQ 100 broke down significantly during the trading session on Friday, reaching down towards the 50 day EMA before turning around and rally rather significantly. At this point, it looks as if the market is likely to continue going higher over the longer term, as traders stepped in at the end of the session to pick things up that had been sold off far too much. The shape of the candlestick is obviously bullish, and I do think at this point we have plenty of support near the 11,000 level.

The shape of the hammer is something to pay attention to and if we break above the top of the daily candlestick for the Friday session, we could end up going all the way towards the top of the Thursday session. While I know that the NASDAQ 100 has been overdone, because it is likely that the “weak hands” have been shaken out, a lot of value hunters have come in to pick up stocks such as Apple, Amazon, Netflix, Facebook, and the like. Looking at this chart, it is likely that the market should continue to go much higher and reach the highs yet again.

To the downside, the market was to break down below the 11,000 level, the market is likely to go down towards the 10,000 level, which is a large, round, psychologically significant figure. All things being equal though, it seems to be very unlikely to happen anytime soon, so I like the idea of buying dips unless we break down below the 50 day EMA, which would be a break down below the hammer for the trading day on Friday.

The jobs number was a bit better than people anticipated, so it does make quite a bit of sense that we would recover in the markets eventually. Quite frankly, a lot of the noise in the market was due to options and hedging by brokers, as they may have to cover positions. All things being equal though, this is an uptrend and there is no point in time where that has been threatened significantly, at least not for something that would be sustainable. Now that we have recovered nicely, I suspect that once we get back to the Monday session, people will feel much more comfortable about buying the dips.