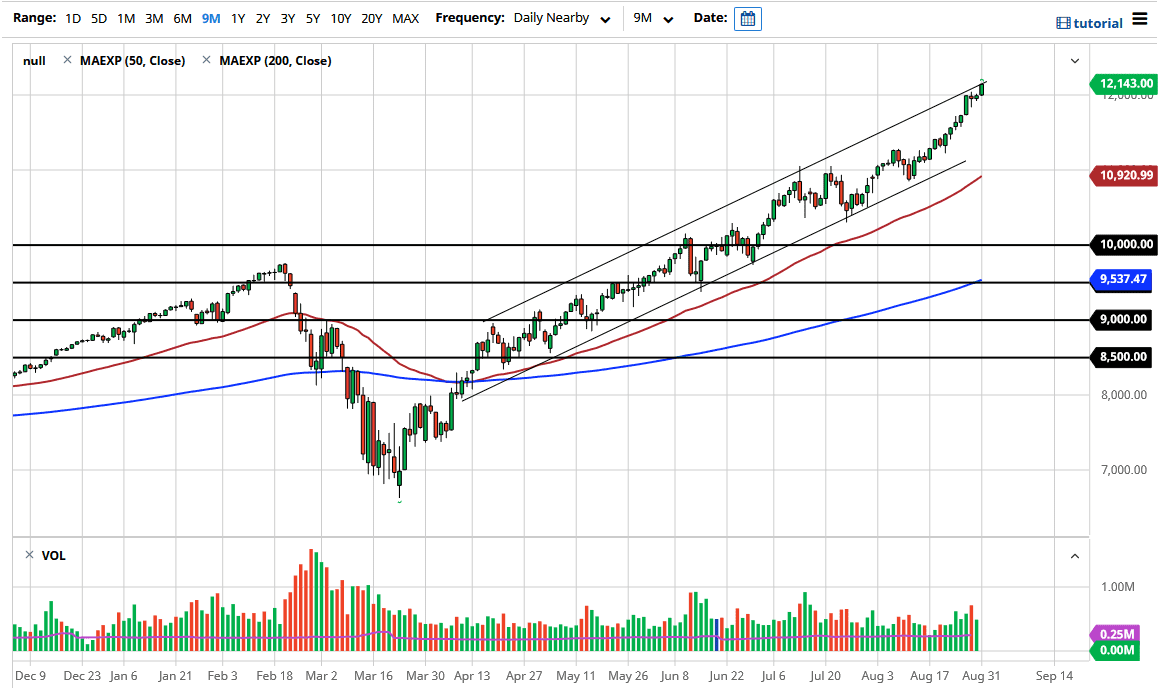

The NASDAQ 100 has rallied again during the trading session on Monday, as we continue to see money flow into the tech sector. We are currently testing the top of a major up trending channel, and a lot of people will be paying attention to that. However, the 12,000 level underneath will be a psychologically important level, so the question now is whether or not we can continue to go higher? At this point, it does look like we are going to try to do so, but at this point, it is interesting that we are at this juncture. The question is whether or not we will continue to see the momentum come into this market?

For myself, I would prefer to see some type of pullback that I can take advantage of, but let us be honest here: the NASDAQ 100 does not always give us an opportunity, as it is so explosive and a handful of stocks continue to move this market more than anything else. After all, it is just the usual suspects such as Tesla, Facebook, Microsoft, Alphabet, Netflix, and Apple. Ultimately, this is a market that is on fire, mainly because of these companies. As Wall Street continues to jump into the same companies, the fact that there a massive amount of the weighted calculation in this index will continue to skew the market. Quite frankly, the breadth of the market looks completely different, but at the end of the day it does not matter because the price keeps going higher.

As we get closer to the jobs number on Friday, we may get a little bit of volatility but the market is counting on the Federal Reserve to protect it and save it if we do get some type of massive selloff, so I think that is something worth paying attention to as we see so much in the way of coddling. At this point, I have no interest whatsoever in trying to short this market, because it is in an uptrend, and there is no point in trying to fight that. It is not until something changes quite drastically with the Federal Reserve or some type of external factor that the NASDAQ 100 is going to crater. This is about inflation, and devalued currencies. People are simply trying to buy “assets” in order to fight that.