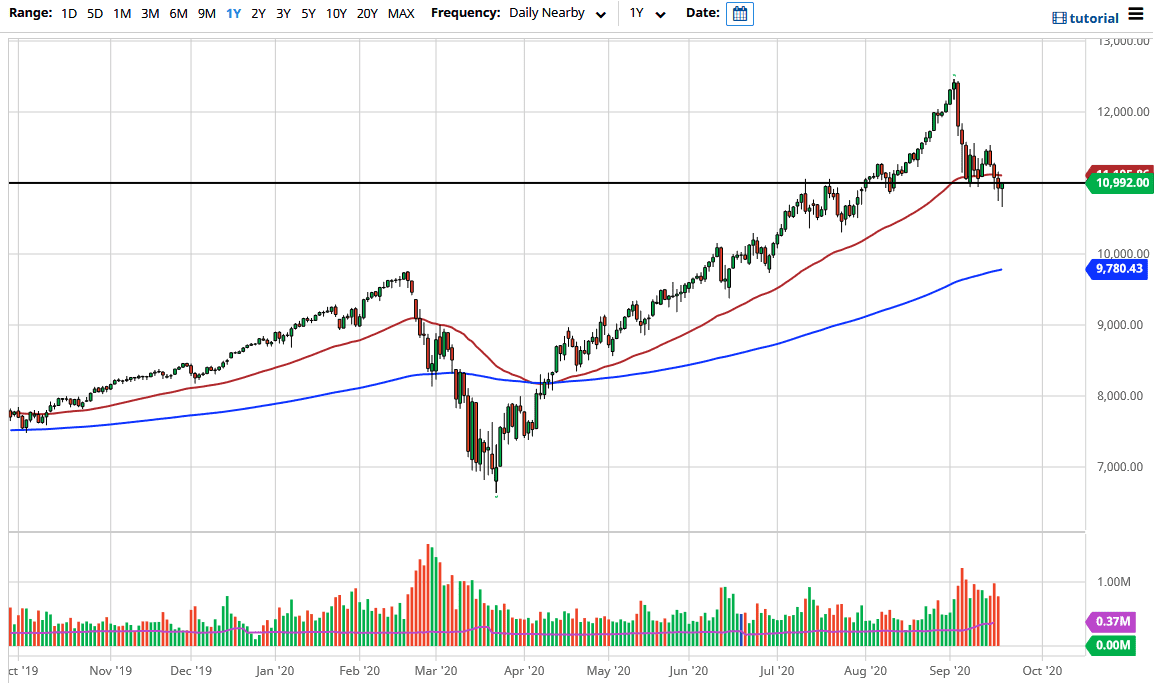

The NASDAQ 100 initially collapsed during the trading session on Monday, and then had a rough day after that. However, by the end of the day, we ended up turning around to form a massive hammer. The market is currently sitting at roughly 11,000 in the futures market, so we could see an attempt to recover in this general vicinity. After all, all of those “household names” are now on sale, so a lot of people might be interested in buying. However, the 50 day EMA sits just above and that could cause some issues, and therefore even if we do rally from here, it is probably more or less going to be a grind instead of a shot higher.

A breakdown below the hammer for the trading session on Monday would be very negative and it could send this market even lower. Initially, I would look for a move towards the 10,500 level, possibly the 10,000 level. Just below the 10,000 level we have the 200 day EMA which is an indicator that a lot of people will pay attention to. To the upside, once we get past the 50 day EMA we have a lot of work to get past the 11,600 level.

If we do break above the 11,600 level, then the market is likely to go looking towards the 12,000 level, possibly even the highs again which is closer to 12,500 above there. I do not think that happens in the short term, but the hammer that formed on both Friday and Monday does suggest that perhaps we have seen most of the worst-selling. However, a break down below this hammer on Monday would open up a bit of a trapdoor and it is likely that we would see even more pressure.

What is worth paying attention to more than anything else at this point in time is going to be the US dollar, and if it continues to strengthen, we will see the NASDAQ 100 take a bit of a hit as well because it is extraordinarily negative when it comes to risk assets such as the NASDAQ 100 and other stock indices. I do believe that we are on the precipice of something big happened, be it recovery or breakdown.