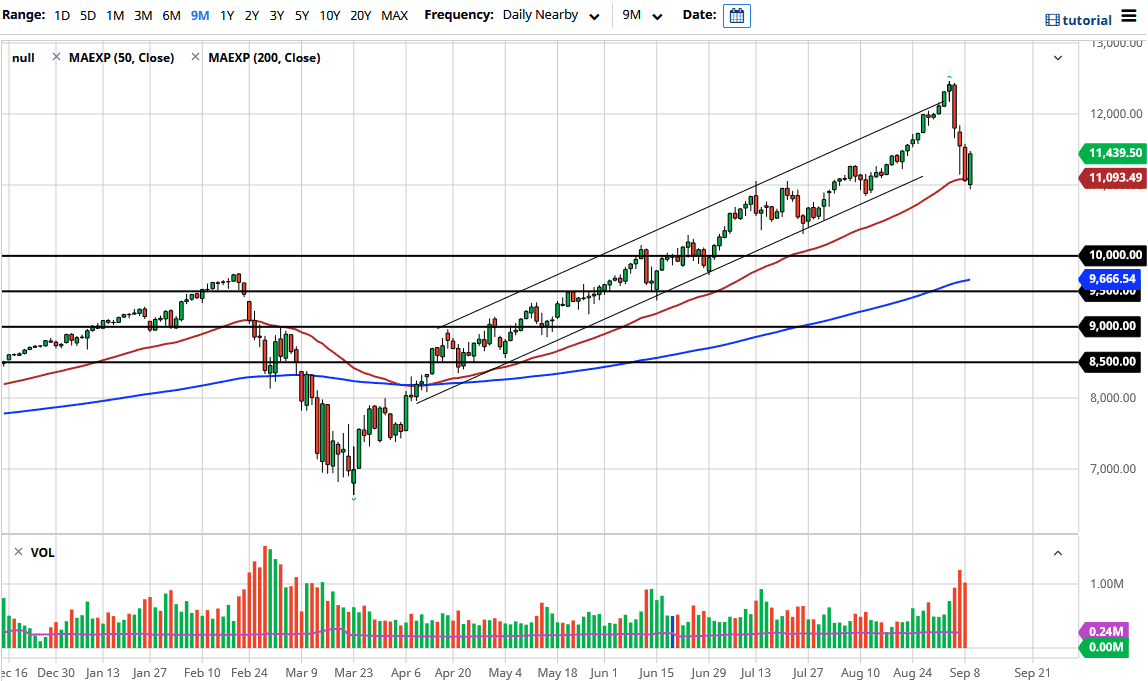

The NASDAQ 100 rallied off of the 11,000 level during the trading session on Wednesday, an area that I said needed to hold in order to save the uptrend. Furthermore, the 50 day EMA sliced right through there as well, so that is a good technical signal. However, we still have a long way to go before we wipe out all of the losses of the last several sessions, so although things do look a bit better at the end of the session on Wednesday, it is a bit early to start celebrating.

With Softbank out there doing the so-called “gamma squeeze” on the markets, the most recent rally was essentially fake. That being said, I believe that the market will try to give back towards the highs, but we may have a lot of work to do in the meantime. At the first hint of trouble though, people will be bailing out of this market, running for shelter. I think the NASDAQ 100 is much more fragile than the S&P 500, so if it has been sold off, this market could really fall rather hard, perhaps going down to the 10,500 level and then the 10,000 level. Quite frankly, as drastic of a move as a drop of 1000 points sounds, it would actually be healthy from the longer-term perspective when it comes to this market.

I have no interest in shorting this market though because indices are not built to be sold. They are comprised done of everybody’s favorite stocks creating over 40% of the value, at least in this case, so, therefore, it is something that you only buy unless the world is essentially coming to an end. It simply is a matter of looking for some type of value to take advantage of what should be a significant pullback and a move higher. That is the appeal of trading indices, you get the exposure to the companies that everybody else wants, without trying to figure too much out other than the direction of the overall market. When you look at historical charts, these things go higher over the longer term. With that being the case, I am simply waiting for some type of corrective wave and then a bounce in order to get involved. If you are looking to pick up value, then it is likely to be a market that you need to enter into slowly and in little bits and pieces.