This is an important thing to do when you are talking about trading volatile stock indices, because if you get too close to the price action, it is hard to see the longer-term trend. This is a mistake that a lot of traders make, not just new ones.

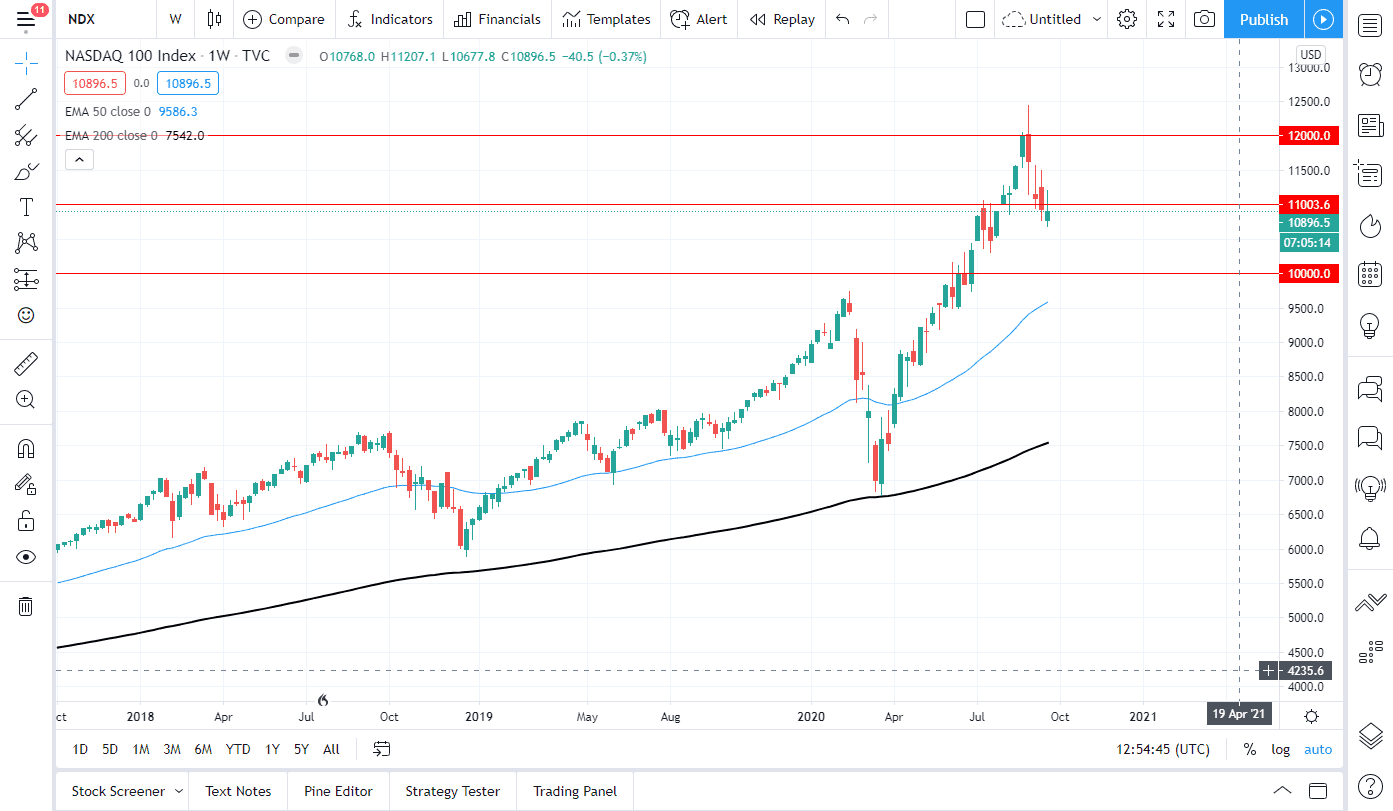

That being said, as we close out the month of September it certainly looks as if we are trying to break down even further. This sets up an interesting target underneath of 10,000, which is a large, round, psychologically significant figure and of course will attract a lot of attention. Obviously, this is a market that I think will continue to be choppy and volatile, and as we go into the month of October, we are getting very close to the presidential elections in the United States which will cause even more havoc in the markets. Given enough time I believe that this market will find a reason to rally, but it may be several weeks or even a couple of months before it happens with any sustainability. There is a gap that we blew through at the 9500 level that extends down to 9000 as well, so that would be your next support level.

There is the possibility that we get some type of stimulus out of Congress, although right now it is hard to imagine them working on anything together. If that happens, I suspect that the NASDAQ 100 will shoot straight up in the air and go back towards the highs. What we have seen over the last couple of weeks though is there does seem to be a significant amount of selling pressure just above the 11,000 handle so I believe that is going to take several attempts to break through. By the look on the chart, it is very possible we may go looking towards 10,000 before we stabilize completely. Unfortunately, volatility is only going to get worse, not better, and of course as there are so many moving pieces out there was so many different issues to be worried about, the question then becomes what happens to the “big five” that drive this index? Netflix, Microsoft, Alphabet, Apple, and Facebook contribute about 40% of the overall weighting in this marketplace so it is imperative that you pay attention to all of the stocks at the same time.