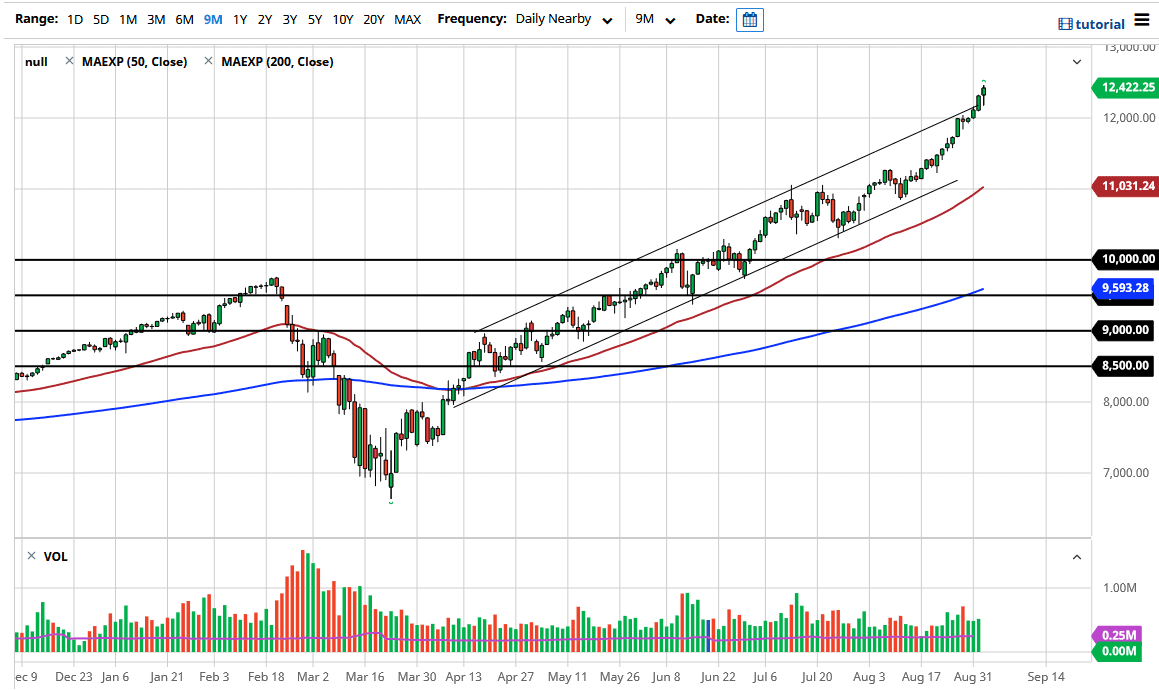

The NASDAQ 100 initially fell during the trading session on Wednesday as one would expect, due to the fact that we had broken above the top of the up-trending channel, and therefore are starting to get parabolic. At this point, it is likely that we continue to go higher, but at this point in time, any signs of exhaustion will probably have people running for the exits. I believe that the 12,000 level underneath could be rather supportive, but at this point, we need to crash back down towards that level. The higher we go, the more dangerous this market then becomes.

Thursday could end up being bullish, but I also recognize that we have the Non-Farm Payroll announcement on Friday that could cause a lot of havoc as well. This is one of the situations where sooner or later you are going to see everybody run for the hills at the same time. When that happens, it ends up being very ugly. Yes, I realize anybody that has been shorting the NASDAQ 100 over the last several months has had their face ripped off, but once you get parabolic like this it takes very little to shake the confidence of people. After all, the professionals are looking at this and getting a bit more nervous each day.

I am not calling the top here, but I am calling for a significant amount of caution for the people who read my articles and watch my videos as I have seen a lot of people get really hurt chasing the trade like this. The shape of the candlestick does suggest that there will be buyers on dips, at least on short-term charts. That being said, day trading this market is probably about as good as this gets to the upside, but as soon as we break below the 12,000 level I anticipate that there will be a big “flush lower” that will wipe out a lot of “weak hands”, as that is the nature of the market. Professionals push the market higher, and then need to find liquidity in order to sell their inventory. That is where the retail trader steps and, as they are the ones left “holding the bag.” It is kind of surprising because it is such an obvious thing looking at the chart, but greed takes over in the retail trader gets hurt. The market does not go in one direction forever, and if you are patient enough to see some type of significant pullback, then you can take advantage of what has been a longer-term uptrend.