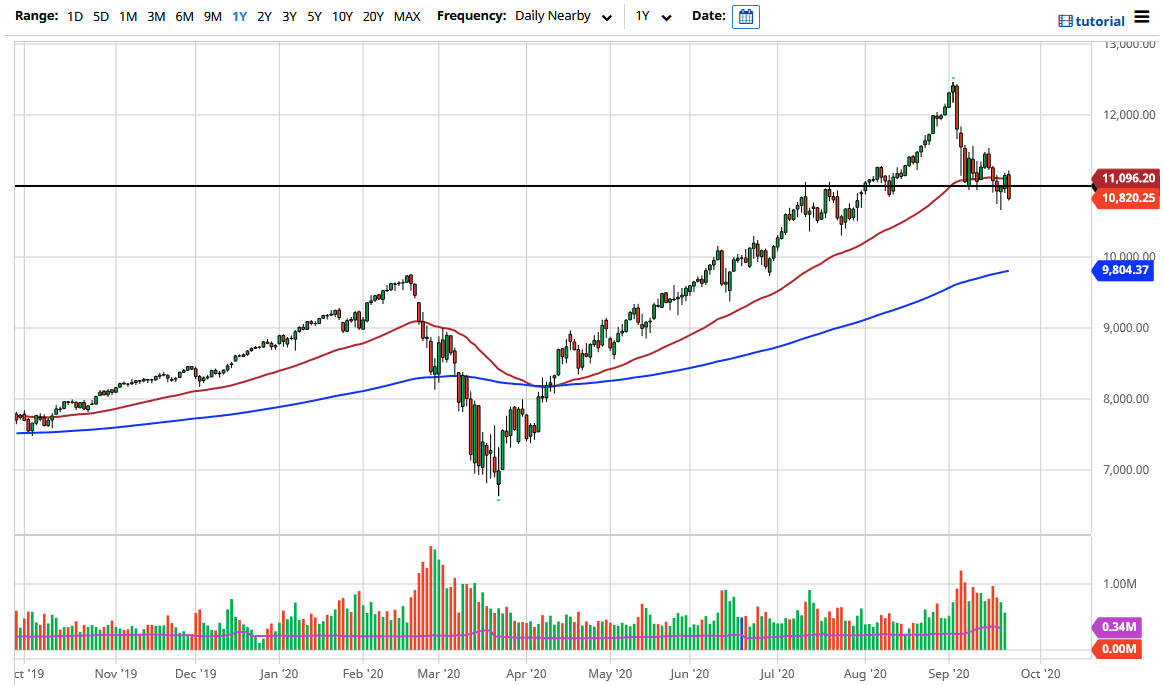

This is a market that I think continues to be hammered due to the fact that the US dollar is strengthening, and that of course is negative for stock markets overall as it has people running towards safety. Remember, the NASDAQ 100 is a risk asset, so that something that you need to pay attention to right away.

With that being the case, now that we have broken clearly below the 11,000 level and unlike the previous sessions held onto those losses, it looks like that we are going to test the 10,650 level, perhaps breaking below there to go looking towards the 10,000 handle. The NASDAQ 100 is going to continue to hurt as long as the US dollar strengthens, and people become concerned. Remember that there are only a handful of stocks that push the NASDAQ 100, so all things being equal you need to pay attention to Apple, Netflix, Alphabet, Facebook, Microsoft, and a slight handful of others.

The size of the candlestick is rather telling, and it does suggest that we have a lot of negativity ahead of us, and I think that short-term rallies will continue to be sold into. It is not until we break above the 11,550 level that I would feel comfortable going long the NASDAQ 100, because quite frankly this looks like it could be the beginning of something a bit bigger. Do not get me wrong, it is only a matter of time before the buyers return though, as they always do. The 10,000 level is going to be crucial as far as I can tell, so at this point in time I think that the 200 day EMA coming into that level also makes quite a bit of sense. All things being equal, I think it is only a matter of time before we get plenty of value but jumping into this market with both feet is not the way to go. A break down below the 10,000 level, it could be an extraordinarily negative move just waiting to happen. In the short term, I think that rallies continue to be sold into, unless of course something changes but the Federal Reserve has made it clear they are willing to step in and do anything in the short term.