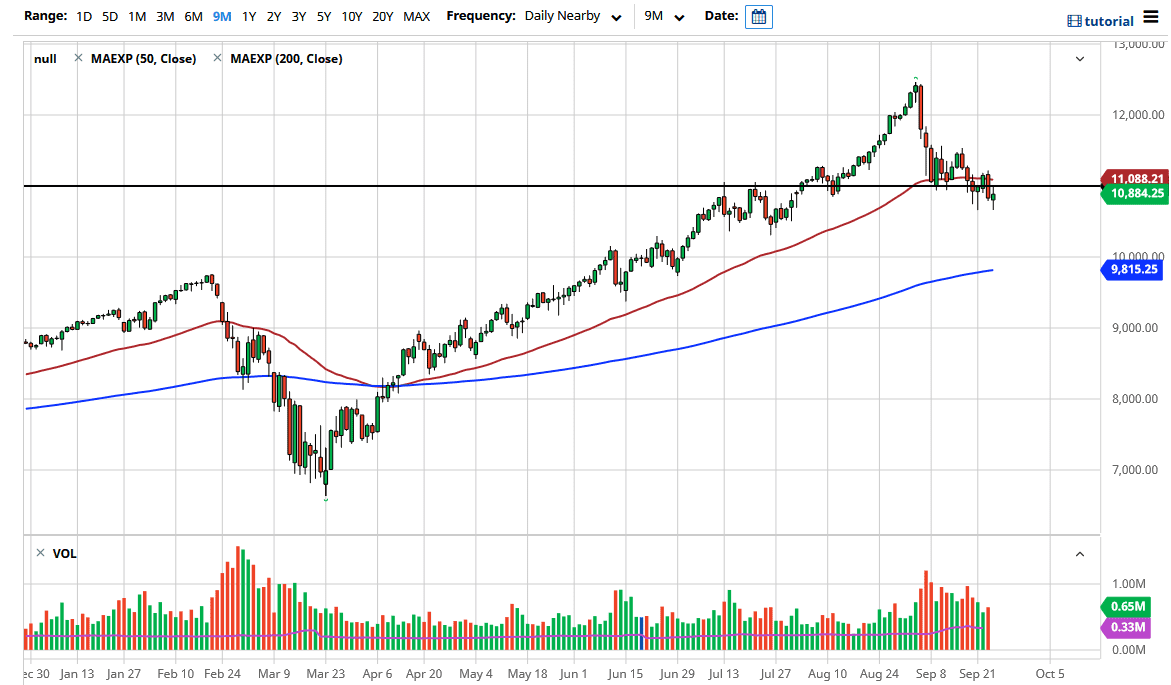

The NASDAQ 100 has gone back and forth during the trading session on Thursday, showing signs of resiliency, but also not necessarily looking overly bullish. At this point I think what we are looking at is a market that is trying to make up its mind for the next move. A lot of what we will see will more than likely be driven by the US dollar and what is doing, so given enough time I fully anticipate that people will start to focus more on the US Dollar Index more than anything else. If the US dollar rallies, then we will continue to see the NASDAQ 100 fall.

The 50 day EMA above near the 11,088 handle is going to cause a bit of psychological and structural resistance, and I think at this point we will probably struggle to get above there for a meaningful move. If we do though, and on a daily close, then I think we could probably continue to rally for about another 400 points or so. On the other hand, if we break down below the bottom of the candlestick for the trading session on Thursday could open up the trapdoor to much lower pricing. I think out of the two major indices that I follow here at Daily Forex, the NASDAQ 100 is probably the more vulnerable of the two.

If we do break down below the NASDAQ 100 lows from the session on Thursday, it will probably drag everything down with it. I think the best case scenario we see some stability, but there are some possibilities out there that could send this market higher. For example, we could get some type of movement towards a stimulus package which Wall Street is screaming for right now, but Washington seems very unlikely to produce. We can also get a US dollar sell off heading into the weekend, but whether or not it is significant remains to be seen. I think we are looking at a very choppy Friday session at best and should probably reevaluate things on Monday morning unless of course we get the breakdown which would be a continuation of the most recent trend. Longer-term though, we are still very much positive and that should be kept in the back of your mind when trading this market, right along with the fact that they are built to go higher over the longer term.