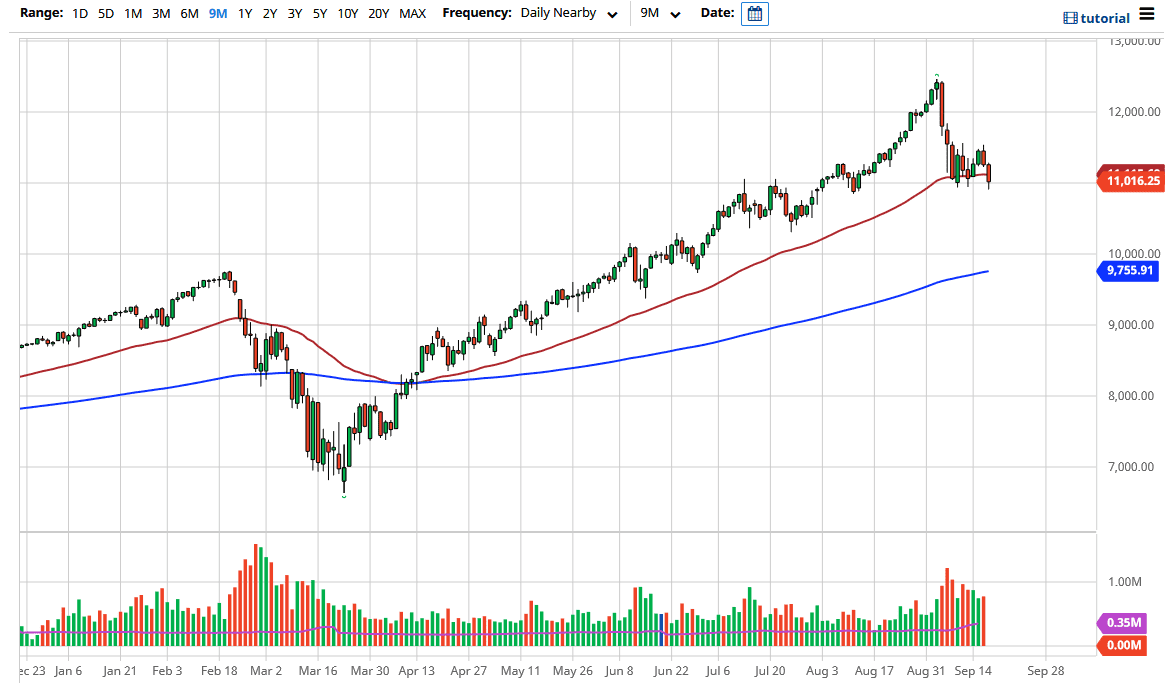

The NASDAQ 100 has fallen again during the trading session on Thursday, reaching down towards the 10,900 level before bouncing a bit. Extensively thinking, the 11,000 level is basically where the support is, and I think it is only a matter of time before we have to decide whether or not this is going to be an area that is going to hold, or if it is going to be an area that the market blows through and goes lower.

If we get a close lower than the low from the Thursday session, it is very likely that the market goes looking towards the 10,500 level, possibly even the 10,000 level. That is particularly interesting, considering that the 10,000 level should be just about where the 200 day EMA comes into play which of course attracts a lot of attention. In fact, although that would be a significant drop, it would still be rather reasonable considering the relentless drive higher that technology has had over the last several months.

Keep in mind that the NASDAQ 100 is heavily weighted towards a handful of companies, so that of course means that a company like Netflix can have an outsized influence on what happens next. It is because of that fact that the indices can move quite erratically. At this point, if we do bounce, I think that the 11,500 level above is resistance, and we could run all the way to that area on Friday and still be consolidating. Right now, it looks as if the market is trying to form some type of base around the 11,000 handle, which does make quite a bit of sense after the selloff. However, if the market gives it up right here, then the next move lower will probably be somewhat brutal. Remember, the markets tend to take the stairs higher in the elevator lower. This will be especially true considering most people are in the same handful of stocks. If they start selling off, then the market starts the selloff on the whole. Having said all of that, if we were to break above the 11,500 level, then we are probably going to go towards the all-time highs. Pay attention to the US dollar, because the market will more than likely move in the opposite direction of the greenback as it has for a while