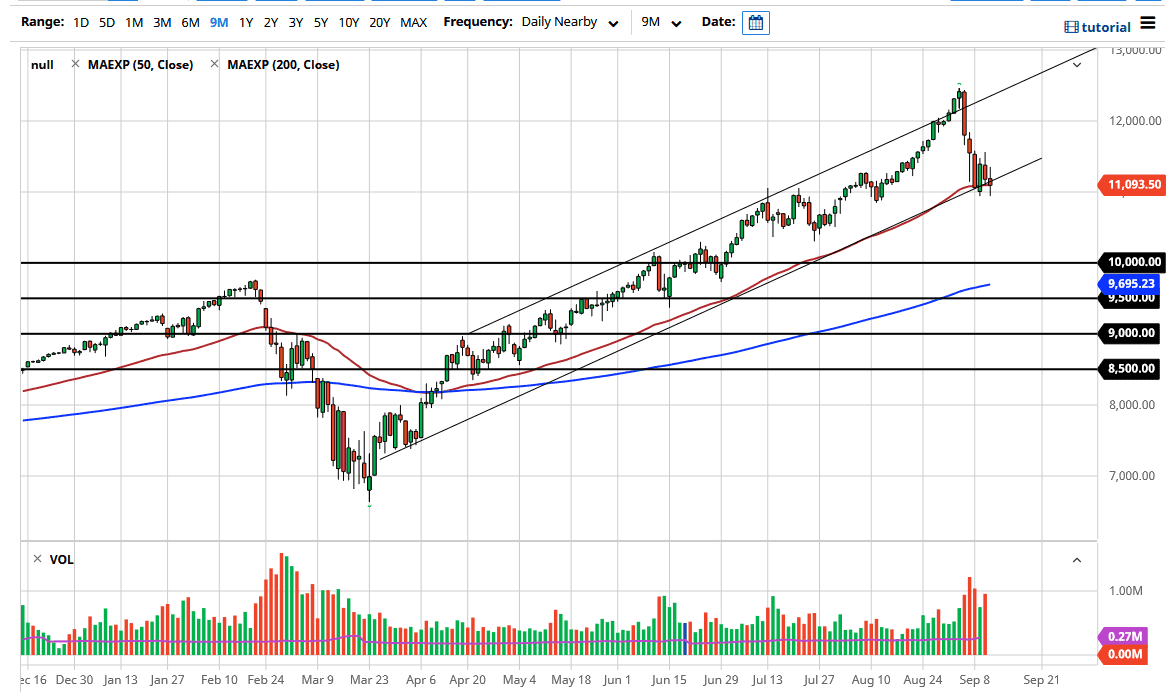

The NASDAQ 100 had a very volatile session during the Friday trading hours, as we initially tried to rally but then turned around to tank again. We did recover near the 50 day EMA, so that indicator continues to attract a lot of attention. However, the market likely is paying more attention to the fact that we are at the 11,000 handle, which is a large, round, psychologically, and structurally important level. Because of this, I think that what we are seeing here is the market trying to decide whether or not the selloff is going to be something a little bit bigger, or if it is finding stability.

While the chart does not necessarily look good at the moment, the one positive thing that I do take away from it is that we did not completely lose it during the trading session on Friday as we could have. Because of this, I think there is at least a small victory that you can take away from the price action on Friday as we did bounce rather significantly from the 11,000 handle. The question now is whether or not traders will come back in a good mood on Monday or not.

There is a lot of concern out there when it comes to global growth and risk appetite, so that is something that should be paid attention to. With everything being equal, I think that we are looking at a scenario where the buyers are trying to take a stand here, and a lot of traders will not want to have gone into the weekend short, because the right words coming out above the right person over the weekend could have this thing gapping higher to kick off the week. With that being the case, it is crucial that you pay attention to how this market opens up, and if we break above the 11,250 level. I think that the trend will save itself and we will continue to try to bounce from here and go looking towards the 12,000 level. To the downside, if we were to break down below the lows of the week, then I think the market goes looking towards the 10,500 level, followed by the 10,000 handle. This would be relatively significant and risk appetite across-the-board would probably be hit by this.