Although the market has taught quite a few traders to go out there and “buying the dips”, the reality is that this type of the selloff is not a one-off event, and therefore we should see more selling going forward. I anticipate that we could be looking at another couple of percent before professionals come in and start to dip their toes back into the water. With that being the case, you need to be very careful about getting involved in this market, although I certainly would not be a seller, at least not right here.

I recognize that people see this big candlestick and they start thinking about all the money they could make shorting the market, but the reality is that the NASDAQ 100, and most other indices are built to go higher, that is why they are not equal weighted. That being said, the best thing you can do is probably simply step to the sidelines and wait for some type of stable daily candlestick before picking up little bits and pieces of this market. Jumping in with both feet is a great way to lose money, unless of course you get lucky and let us face it here: if you are looking to buy with a huge position down at a lower level, you are looking to get lucky.

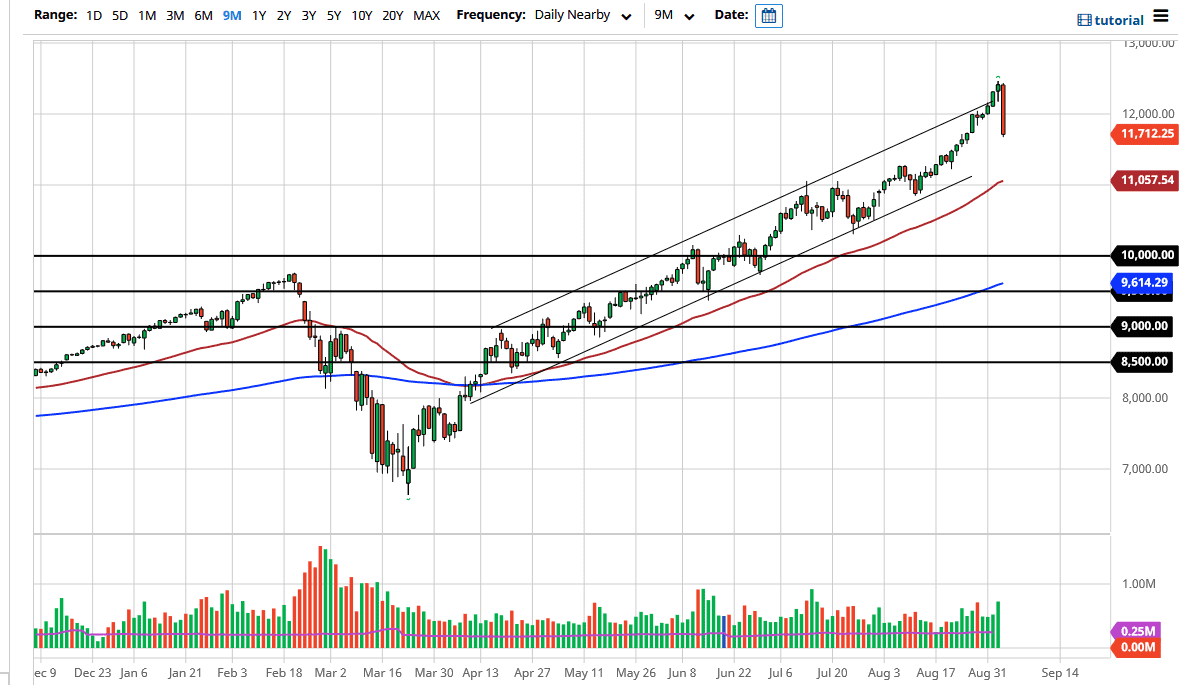

The uptrend line from the channel that we have clearly gotten far too exuberant from is another couple of percent lower as well, so I think this song kind of sets up quite tidy for a value proposition. The market has been on fire for some time, so a 10% pullback is specifically what it needs. The 50 day EMA is just above the 11,000 level, so do not be surprised at all to see that offer a little bit of psychological and technical support as well. In fact, that lines up to the bottom of the channel as well. As for myself, I will be placing the trade in this market on Friday, although I recognize there is potential for serious movement, I would rather get compounding interest working for my account, not gambling and what is almost undoubtedly going to be a very dangerous situation. Let the market tell you what it wants to do and follow. I anticipate either Monday or Tuesday placing the trade.