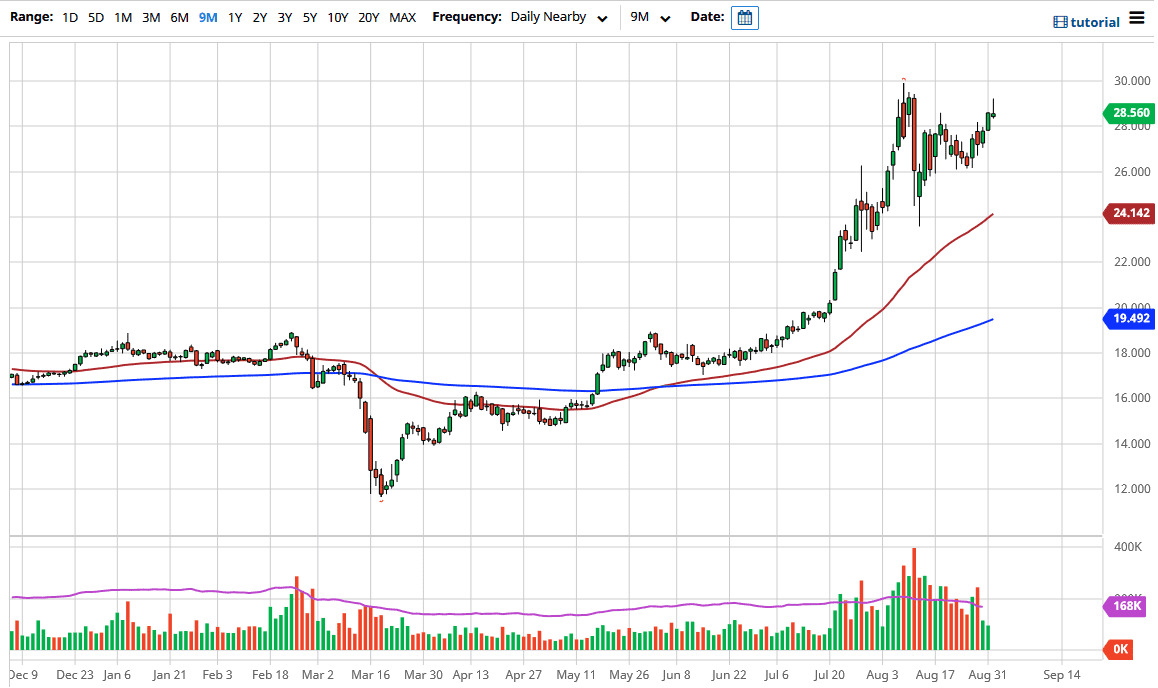

Silver markets initially tried to rally during the trading session, breaking above the $29 level but cratered later in the day as the US dollar picked up strength. This shows just what is driving this market, the strength of the US dollar, or perhaps the weakness, depending on the day. This has nothing to do with industrial demand because the industrial demand just is not going to be there.

This market does look a bit better than the gold market, but both of them look as if they are trying to pull back in order to find buyers underneath. Even though we have formed an ugly shooting star, I have no interest in trying to short this market, because we are in an uptrend for a reason, and that reason of the Federal Reserve. As long as the Federal Reserve is going to be very loose with its monetary policy that is going to continue to devalue the US dollar. By extension, commodities should continue to rise over time. All of that being said, we have gotten a bit ahead of ourselves as of late so a little bit of a pullback should not be a major surprise.

If we were to break above the top of the shooting star, then the market could make a serious run towards the $30 level, because it would show a significant amount of momentum by doing so. It would break a significant amount of short-term resistance, as it would wipe out all of the late Tuesday selling. If we can break above the $30 level, then it is very likely that we continue to go much higher, perhaps reaching towards the $50 level over the longer term. I believe that is more than likely going to be the case given enough time, based upon central bank actions. All of that being said, if we were to pull back from here, I think there is a significant amount of support near the $26 level that should attract a lot of attention and it could end up being a nice buying opportunity. $30 is obviously a very large and psychologically significant figure that the market has paid attention to, so it is worth noting that it may take a couple of attempts to finally clear it.