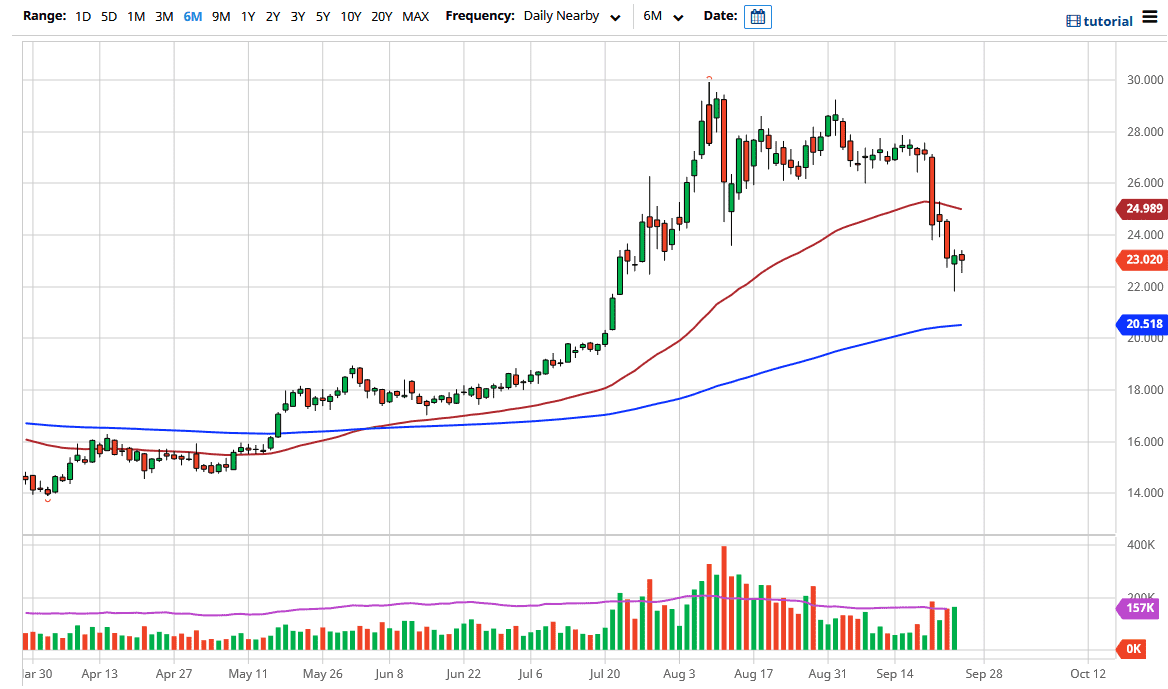

Silver markets have initially dipped during the trading session on Friday but have turned around to show signs of resiliency again. The fact that we have formed a hammer again on Friday as we did on Thursday, it does suggest that we are in fact going to see a bit of buying pressure. The $22 level underneath should be significant support, but this is based upon short-term trading, not necessarily longer-term structural trading.

That being said, if we break down below the bottom of the candlestick from the Thursday session, it is likely that the market can go down to the 200 day EMA, looking at the $20.50 level. Ultimately, even below there we have support at the $20 handle. In fact, the $20 level was a significant area of breakout, and therefore it could be retested, and we could still keep the uptrend going. Obviously, this has a lot to do with the US dollar strengthening, and therefore it works against the value of commodities, especially silver.

The market breaking above the highs of both Thursday and Friday suggests that the market is going to go looking towards the $24 level, perhaps even the 50 day EMA which is closer to the $25 level. The $25 level is a large, round, psychologically significant figure, and combining that with the EMA does suggest that there should be a least a bit of resistance in that area. Breaking above there, the market then goes looking towards the $26 level, but I think we probably need to build up a little bit of momentum before that can actually happen.

You need to pay attention to the US Dollar Index, because if it falls apart, that could help silver. The US dollar had been oversold, so the fact that we shot straight up in the air in the US Dollar Index should not be a huge surprise. At this point, we are essentially in an inflection point, so now we need to figure out where we are going to go longer term. Expect a lot of choppy volatility, but from a longer-term standpoint I still like silver regardless. Central banks around the world continue to flood the markets with currency, and that should be good for hard assets going forward. All of that being said, if we were to break down below the $20 level, it could have the markets looking at a complete breakdown.