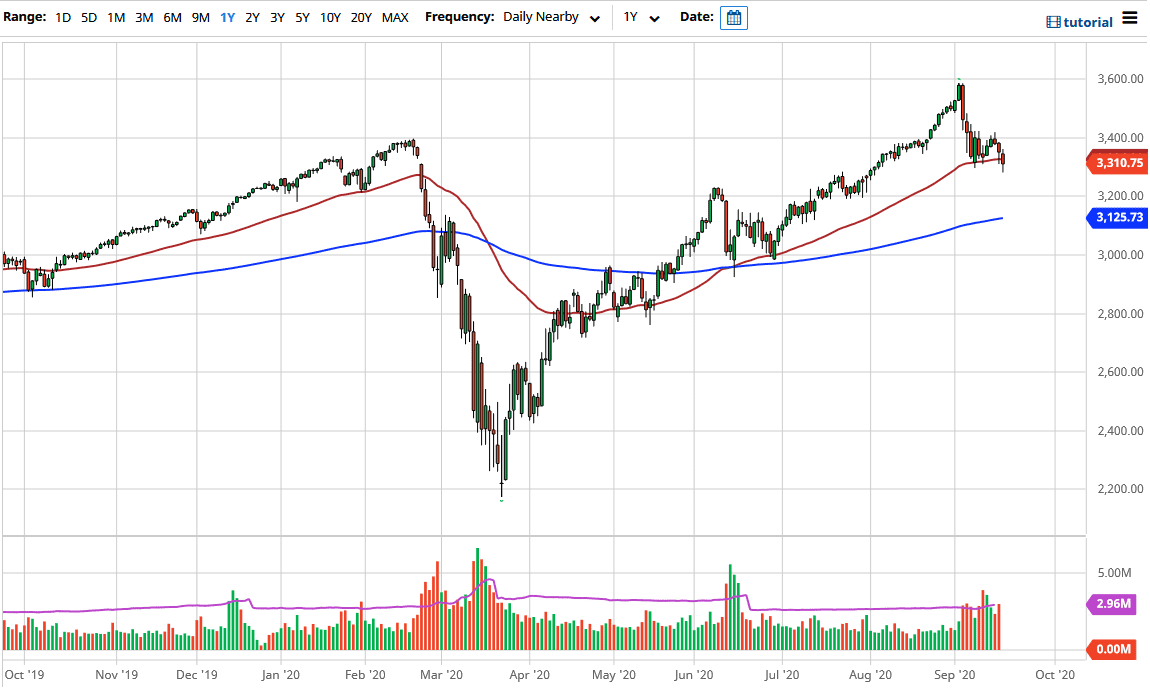

The S&P 500 has initially fallen during the trading session on Friday, but as it was a quadruple witching day, the options market had their say as far as volatility was concerned. Because of this, we have gone all over the place, and looking at this chart it looks as if there is a little bit of support right around the 3300 level, which is a large, round, psychologically significant figure. That is nothing new, the 3300 level is an area that we have been paying attention to for some time, but what is interesting here is that the 50 day EMA is showing up as well and is flattening. So, the question now is not so much as to whether or not there is technical support here, but whether or not we are running out of momentum?

I think it is very possible that we would in fact see the markets calm down a bit right now because I think we are trying to find some type of footing. We are currently trading between the 3300 level and the 3400 level, and this tight range may persist. However, one thing we need to keep an eye on is volatility, which seems to be picking up a bit underneath the market, and if that is going to be the case it is very likely that we struggle. At this point in time, it is a scenario where if we break down below this candlestick for the Friday session, it probably opens up a bigger move down to the 3200 level. That is a level that was previous resistance, so it should now be massive support if we reach down towards it.

To the upside, if we break above the 3420 handle, then it is likely that we go looking towards the highs, but we need some type of catalyst to make the market do that. The Federal Reserve looks as if it is going to stay loose with monetary policy for the rest of our lives, so that would probably be the usual suspect. However, it should be noted that the market has not rallied after the Jerome Powell press conference, so perhaps that might not be enough this time. If that is going to be the case, then we may get a bit of a correction coming relatively soon.