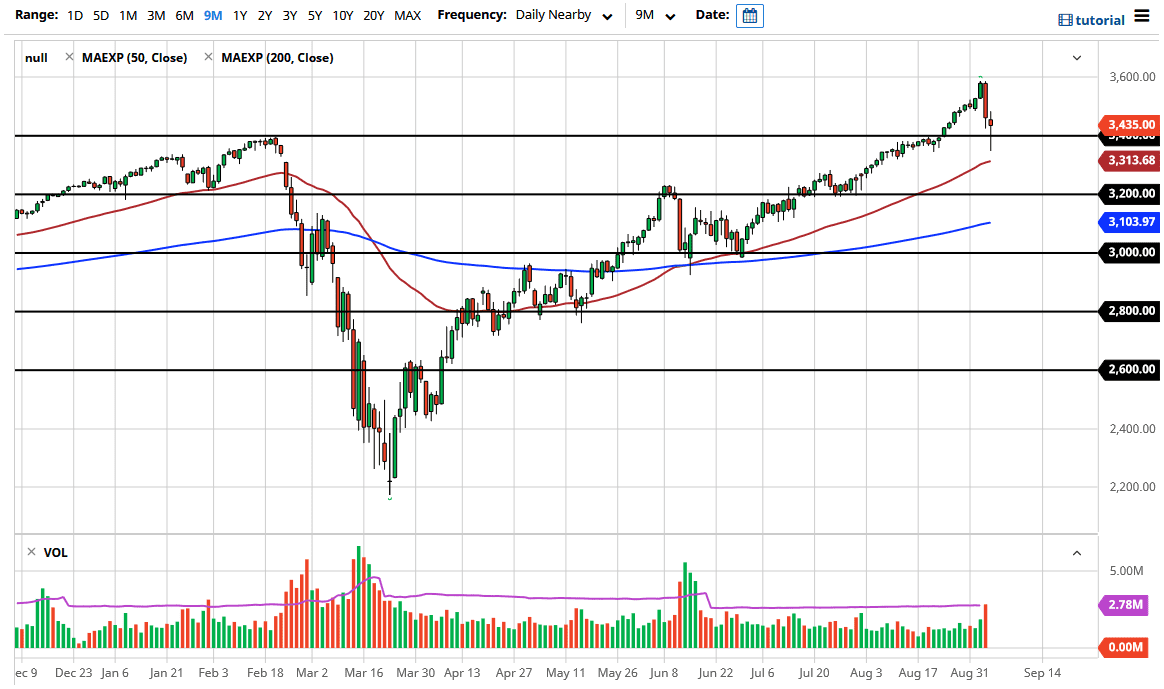

The S&P 500 initially broke down during the trading session on Friday, slicing through the 3500 level. That is a large, round, psychologically significant figure, but it is also the scene of the previous all-time high, so it makes sense that we would see buyers in this area. At this point, it looks like the market is ready to go much higher, and I believe it is only a matter of time before we go looking towards the 3600 level yet again, as the market has a lot of interest in that area.

If we were to break down below the bottom of the candlestick for the trading session on Friday, we would then test the 50 day EMA which is crucial. A breakdown below that level could send this market looking towards the 3200 level, and perhaps struggling just a bit to find some stability. That being said though, the market is likely to continue finding reasons to go higher, perhaps reaching towards the 4000 level given enough time. This is a market that is going to continue to be built on “FOMO”, and a Federal Reserve that is willing to pump the markets higher. Ultimately, this market has a longer-term attitude of bullish pressure, and plenty of liquidity being forced into the market making people buy stocks.

Looking at the market, it was long due for some type of correction, but most people would have preferred that it was not in two short days! That being the case, the market is likely to see plenty of “buy on the dips” trading, as there is so much in the way of momentum. Now that we are through earnings season and a major shakeout, we will probably drift higher into the election, although there is the possibility that a negative headline comes out from the political field that sends the market right back down. That being said though unless the Federal Reserve is going to change its tune, any dip at this point continues to be a possible buying opportunity, especially after what we have seen over the last 48 hours. If the last couple of days have not convinced you that there is a lot of resiliency in this market, I am not sure what well.