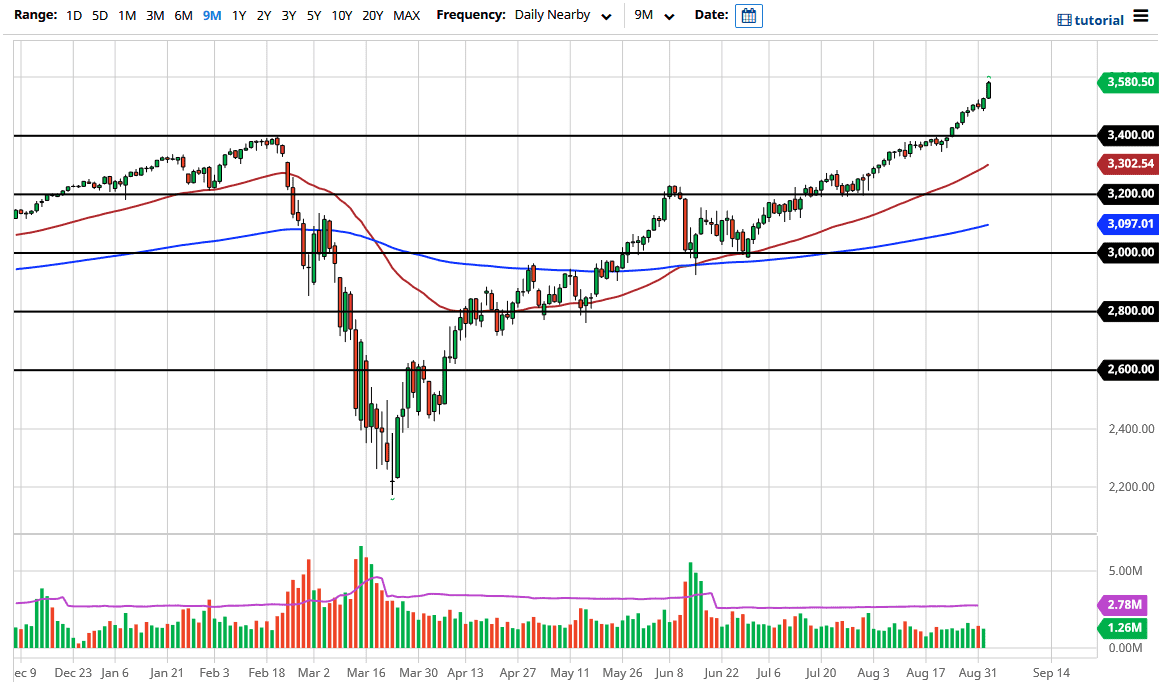

The 3600 level is a large, round, psychologically significant figure that is clearly in the crosshairs of S&P 500 buyers. We are closing towards the top of the candlestick and is very likely that could see a little bit of follow-through. That being said, you need to be very cautious as we have the jobs number coming out on Friday, and that will cause a lot of volatility. Furthermore, the 3600 level will cause a bit of selling as it is a longer-term target for a lot of traders out there. In fact, if you look at the longer-term charts of the S&P 500, it does tend to move in 200 point increments.

To the downside, the 3500 level should offer a bit of support, but I would like to see this market pullback towards the 3400 level. A lot of this will come down to the US dollar and whether or not the Federal Reserve continues to flood the markets with them, which they will. That does not mean that you just jump in and start buying hand over fist, because that is a great way to lose money.

I think at this point you need to find some type of value in this market because it has gotten so expensive. Ultimately, this market does want to go above the 3600 level, but I think that is a story for next week. If we do break out above there, then it is possible that we would see the markets show some type of impulsive move, which can go much farther than you anticipate. That being said, it is a really good way to lose money, so I do not advise chasing. It is worth noting that the S&P 500 did not even bother pulling back during the trading session on Wednesday, even as the NASDAQ 100 did. Because of this, I think it shows just how ferocious the buying is, but we should also keep in mind that we are in the midst of traders just now coming back from vacation, and a lot of them probably are not putting on huge positions right before the employment figure. Because of this, I think we will have a little bit more clarity next week but going forward I am still in the “buy on the dips” type of mentality.