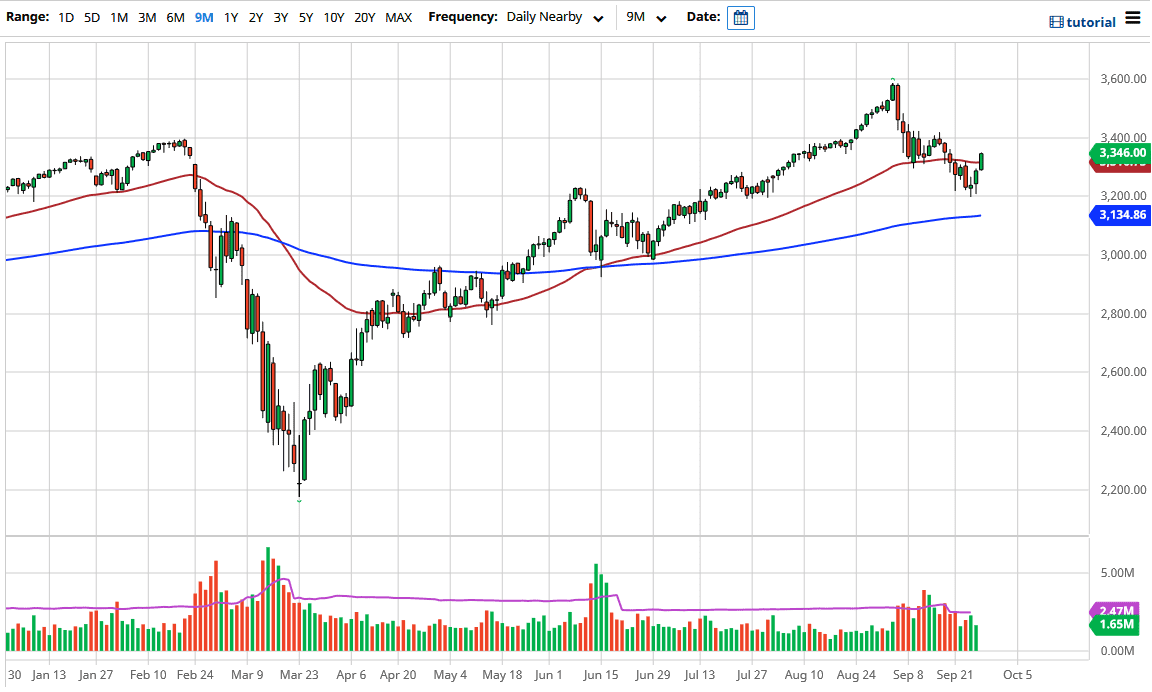

This is a market that we should continue to see a lot of volatility in, but I think at this point we are probably going to go looking towards the major selling area of 3400. This is a market that has been in a 200 point range, and I think the 3400 level is the resistance, while the 3200 level underneath is support. The 50 day EMA slices right through the candlestick during the trading session on Monday, so that is something worth paying attention to as well.

If we were to turn around a break down below the 3200 level, then it could kick off another leg lower. The 200 day EMA underneath causes a lot of potential support as well, sitting at the 3134 level. Breaking down below that level opens up the possibility for a move down to the 3000 handle which of course is a large, round, psychologically significant figure. That probably comes in line with some type of major “risk off scenario”, which of course a lot of people will pay attention to. To the upside, if we were to break above the 3400 level then it kicks off the next leg higher, which could send this market towards the 3500 level, possibly even the 3600 level. We have been in an uptrend over the longer term, so I do think that we are going to see the uptrend reassert itself eventually, but I also believe that we have a significant amount of volatility between now and the presidential election so it is difficult to just simply “buy-and-hold.” I think you are going to have to trade more or less this 200 point range until the market changes its overall attitude. Do not be wrong, we clearly can but at this point I have to assume that this range holds.

I believe that you probably are going to see more day trading than anything else right now, so keep your position size relatively small because the volatility is going to pick up on the latest headline, and of course various news items. The jobs number comes out on Friday so that of course has its influence as well, so make sure that you are cautious.