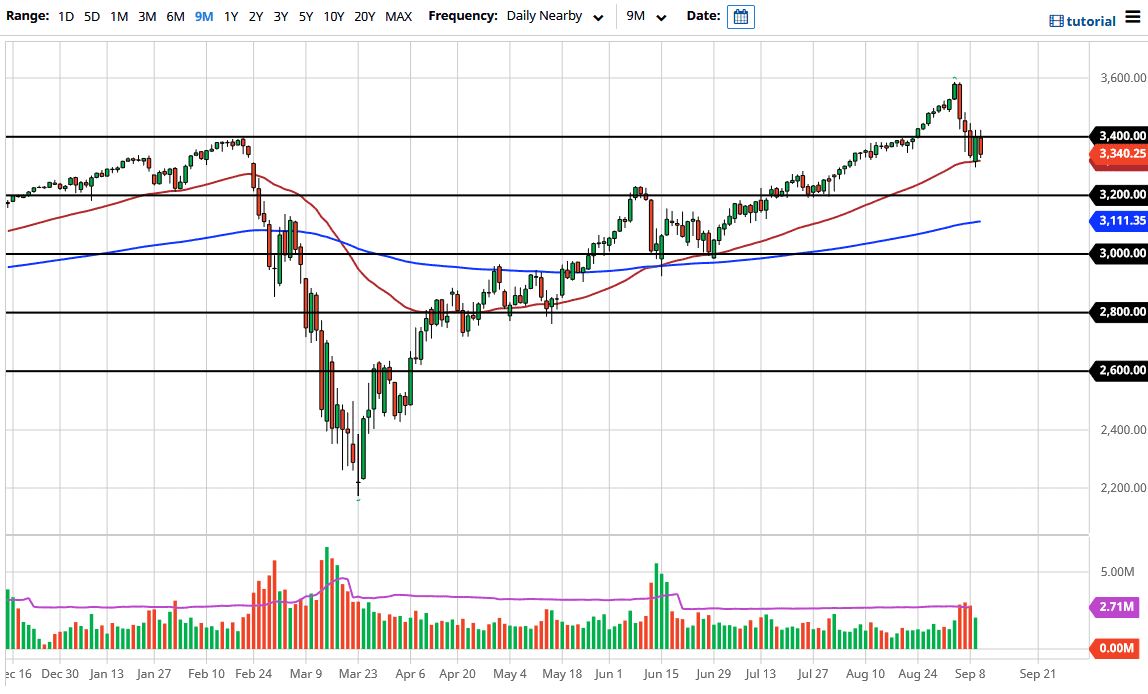

The S&P 500 initially tried to rally during the trading session on Thursday, but then broke down towards the 50 day EMA that of course is crucial. The 50 day EMA of course is something that people have been paying attention to for some time, and the last couple of days has offered a significant amount of support. Furthermore, the market is sitting around the 3350 level, which is also a midcentury figure.

If we were to break down below the lows of the session on Wednesday, then it is likely we go down towards the 3200 level. The 3200 level of course is a large, round, psychologically significant figure. This is an area that has previously been resistance, so therefore it should be supported based upon “market memory.” Looking at this chart, the 200 day EMA is starting to reach towards that area as well, so it is possible that it becomes even more supportive based upon that. If we were to break down below the 200 day EMA, that would actually be a massive trend change. Looking at the chart though, we are very bullish but obviously we have had some issues in the last several sessions.

The question now is whether or not we can pick up momentum again, which right now we have clearly lost. If we can break above the highs of the last couple of days, then it is possible that we could go higher. That being said, it is very likely that going into the weekend people will be very cautious about holding onto futures positions. However, if we were to rally significantly, the market is likely that we will continue going forward because it shows real resiliency to be able to hang on to risk. It is difficult to imagine that being the case though, unless of course something changes rather drastically. To add more fuel to the fire, we now have a Brexit nonsense grabbing the headlines, so people are starting to worry about that as well. Stocks are overvalued, but at the same time we have the Federal Reserve willing to dump money into the marketplace as well. With that being said, I think we are best served waiting to see how that we close out before putting money into this market, as Friday is very likely to be very difficult.