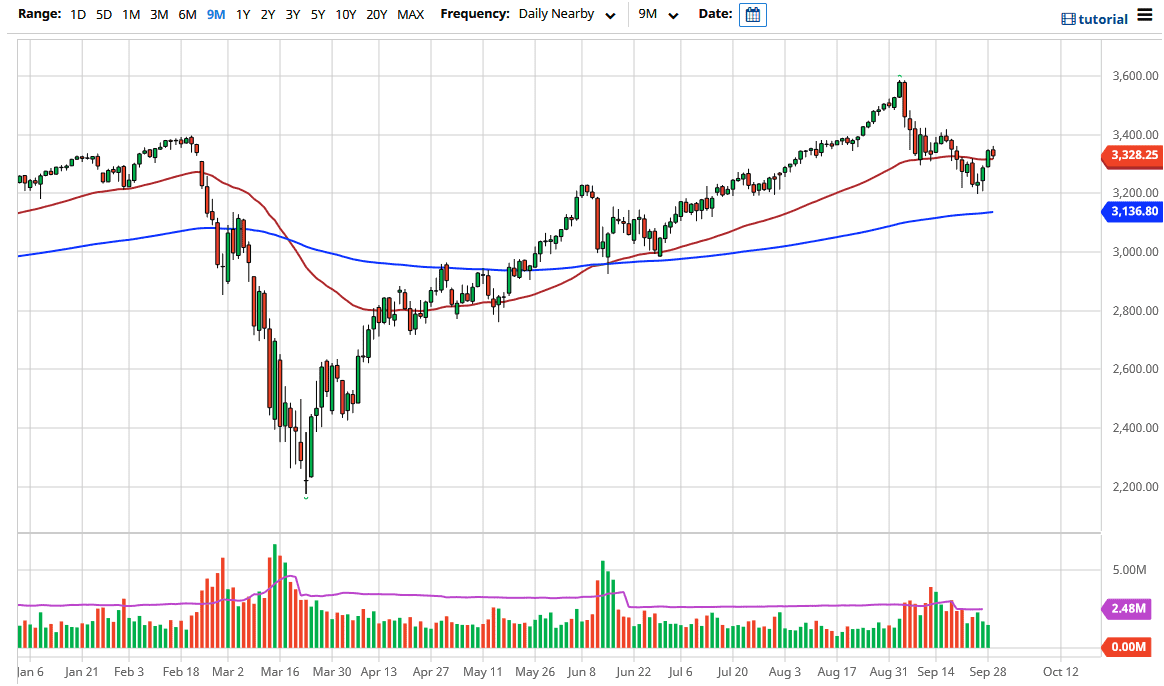

The market has been very noisy during the trading session on Tuesday, as we continue to see volatility in the S&P 500. Ultimately, we had quite a bit of noise during the trading session as we tried to rally during the Globex session, only to fall towards the 50 day EMA. The 50 day EMA is a technical indicator that a lot of people pay attention to, and therefore it is not a huge surprise to see that we bounce from there.

The market looks likely to trade in a range overall, and the 3200 level underneath is massive support. The 3400 level above is massively resistant. That being said, the 50 day EMA will also be a bit of a magnet for the price as it typically is, so I think at this point we are simply trying to figure out where to go next. The fact that we are at the end of the quarter and the end of the month suggests that we may have a bit of rebalancing when it comes to the indices, and all of the stocks that money managers own. Ultimately, this is a market that I think continues to see a lot of back and forth over the next couple of days, not to mention the fact that we have the jobs number coming out on Friday.

If we do break down below the 3200 level, it is likely that the market goes looking towards the 200 day EMA underneath. The market breaking down below there would open up the possibility of a move down to the 3000 level which is a large, round, psychologically significant figure and an area that will attract a lot of headlines. Breaking above the 3400 level more than likely opens up the possibility of a move towards the 3600 level, but we would obviously need some type of positive catalyst to send the S&P 500 market much higher. The US dollar fell during the trading session and the S&P 500 could not take advantage of the cheaper US dollar, which is a bit odd. Ultimately, this is a market that I think is going to bounce around in this general vicinity so although I believe longer-term, we go higher, we probably have a short-term pullback ahead of us only to see buyers eventually.