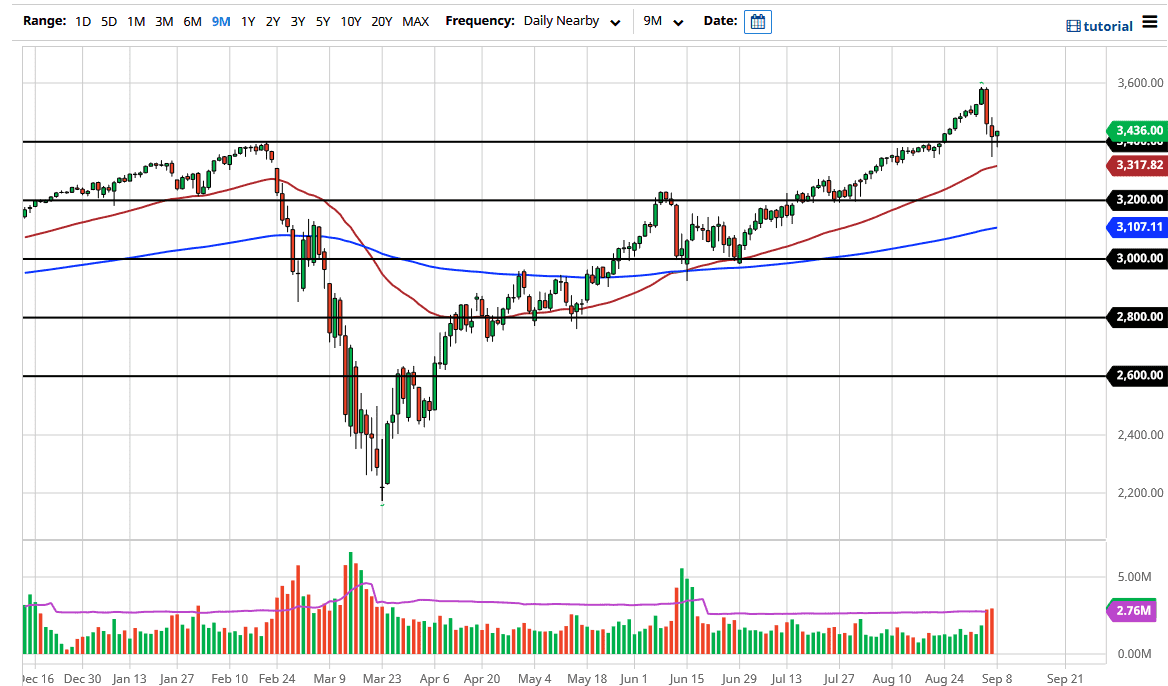

The S&P 500 fell initially during the trading session on Monday in thin electronic trading as it was the Labor Day holiday in the United States. Because of this, you can only read so much into the price action, but it is worth noting that we have stuck to the idea of 3400 been supportive, as we formed a massive hammer during the trading session on Friday. At this point, I believe it is only a matter of time before we go higher, perhaps reaching towards the 3600 level. That is a major barrier, as we had sold off so drastically from that level. I think that if we go back there to retest that area, it is going to take a significant amount of momentum to get through it.

Do not be wrong, that does not mean that we will not do it, just that it may take some serious work. That being said, it is more or less going to be a “grind higher” more than anything else. I think that the 3400 level will be an area that people pay quite a bit of attention to, but underneath there we also have the 50 day EMA which is near the 3325 handle. All things being equal, I think that this is still a “buy on the dips” type of scenario, because unlike the NASDAQ 100, although we had gotten a little ahead of ourselves it was not overly done.

The shape of the candlesticks over the last couple of days suggests that we should have plenty of buyers and I think that it is only a matter of time before we take off again. That being said, I like the idea of a slower rise to the upside as it is much more sustainable, and stock markets have gotten a bit frothy as of late.

To the downside, I believe that if we break down below the 50 day EMA, it is very likely that the 3200 level is the next major support level. It is an area that has been supportive and resistive in the past, so it makes sense that there should be a bit of market memory in that area for the people pay attention to. I have no interest in shorting the S&P 500, it is extraordinarily bullish from a longer-term standpoint, so there is no need to fight that.