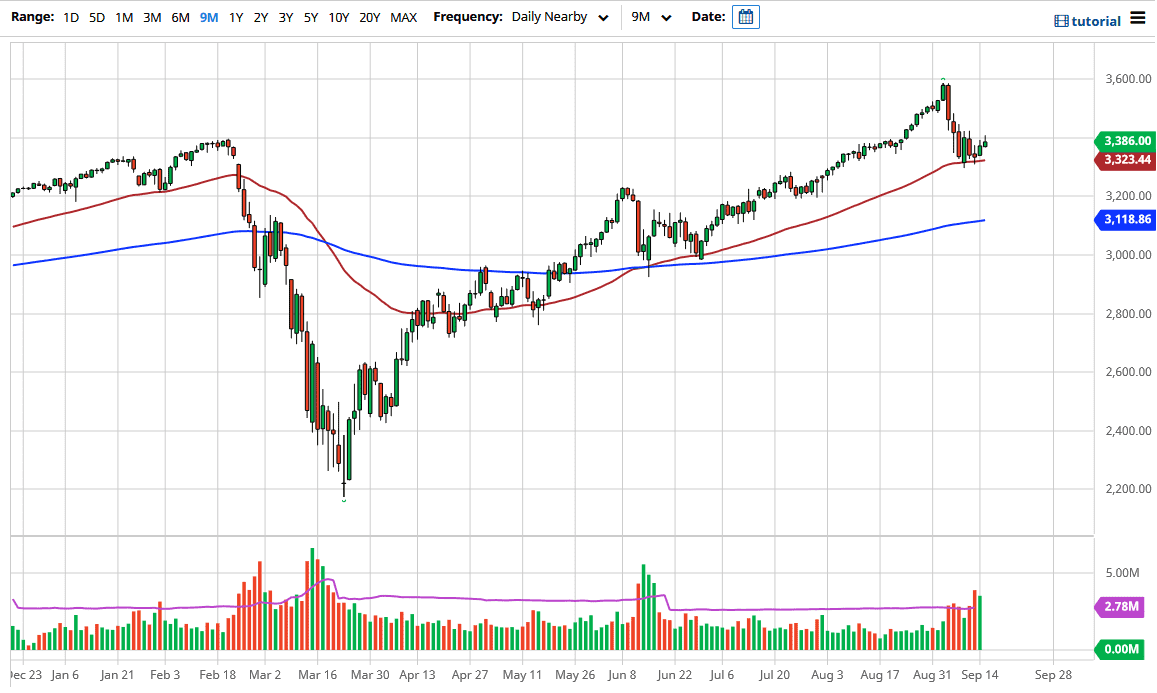

The S&P 500 rallied quite significantly during the trading session, slamming into resistance yet again during the day on Tuesday. However, we gave up the gains and ended up forming a bit of a shooting star. By doing so, the market is likely to see more consolidation as we sit just below a significant resistance barrier in the form of 3420, so it looks like we are still stuck in this overall range. To the downside, the market is going to continue to see the 50 day EMA as support, and the 3300 level. If we were to break down below there, then the market could go looking towards the 3200 level.

The 3200 level was previously resistant and that should now offer structural support, as we have seen a breakout from there, and then a retest of that support. The 50 day EMA also offer support as mentioned previously, so there are a couple of reasons to think that we are eventually going to find buyers unless some type of negativity it is the market with ferocity. At this point, at the very least I think we are trying to go back and forth in order to build up a bit of a base for the next move higher. You will know that the markets are trying to find more momentum to the upside on the day that we end up closing above the 3320 level on the daily chart. Once that happens, we could go looking towards the highs again, which would probably have something to do with the Federal Reserve stepping in and doing something.

Right on cue, we have the FOMC statement coming out during the day on Wednesday, so it is possible that they actually do something to send this market higher. I would not hold my breath on it though, and if the market still gets some type of assurance that the Federal Reserve has their collected backs, we could see some type of tantrum being thrown by Wall Street to send the market lower. At that point, Jerome Powell will have learned his lesson yet again, and step in to offer liquidity to the market. The Federal Reserve has been held hostage by Wall Street for some time, so I do not see how that changes anytime soon. At this point, the uptrend is still very much intact as long as we are above the 200 day EMA which is at roughly 3110 currently.