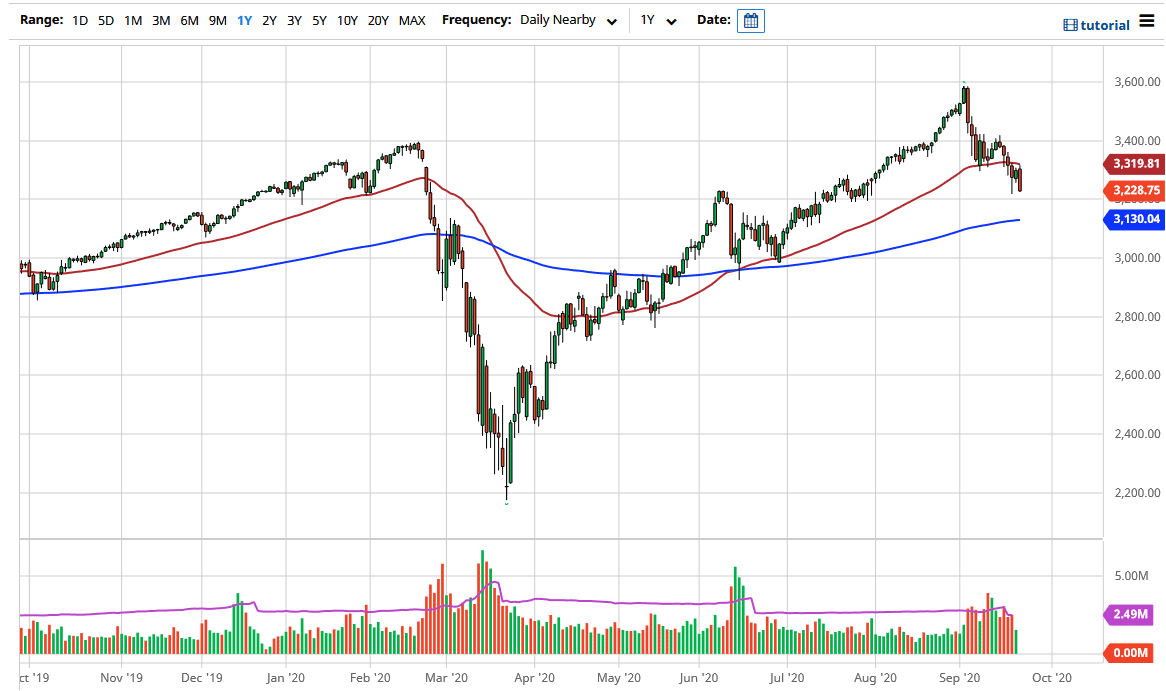

The S&P 500 has initially tried to rally during the trading session on Wednesday but gave back the gains as we reached towards the 50 day EMA. By breaking down the way we have, it is likely that we are going to try to reach down towards the 3200 level. That is an area that has already shown itself to be supportive. It is a large, round, psychologically significant figure and of course the previous resistance at this point in time, I think it is too juicy of a target for people to ignore. Even if we do break down below there, I think there is plenty of support to be found near the 3180 handle, based upon a previous gap, and then of course the 200 day EMA which is closer to the 3140 handle.

The market has shown itself to be rather fickle, and the fact that the Federal Reserve does not look likely to help it will have the market reeling in the short term. Given enough time though, I think one thing you can count on is that the Chairman of the Federal Reserve will eventually “see the light” and come to bail out Wall Street. We may need to see a relatively large tantrum in order to make that happen, but that would not be the first time.

I think as long as we stay above the 3000 level, you are still looking for buying opportunities, but you need to see it on a daily close in order to trust any type of signal. I would not step into this market suddenly in the middle of the day, because quite frankly the headlines will come fast and furious, and therefore you cannot trust the short-term charts. You need to see at least a full day of stability if not more to get any risk on in this type of environment. I do believe that there will be a significant amount of interest in this market closer to the 200 day EMA and possibly even that previously mentioned 3000 handle. I think in order for the market to break down below the 3000 level we would need to see some type of short-term catastrophe. If we turn around and break above the 3400 level, then it is likely that we are going to go looking towards the 3600 level which was the all-time high.