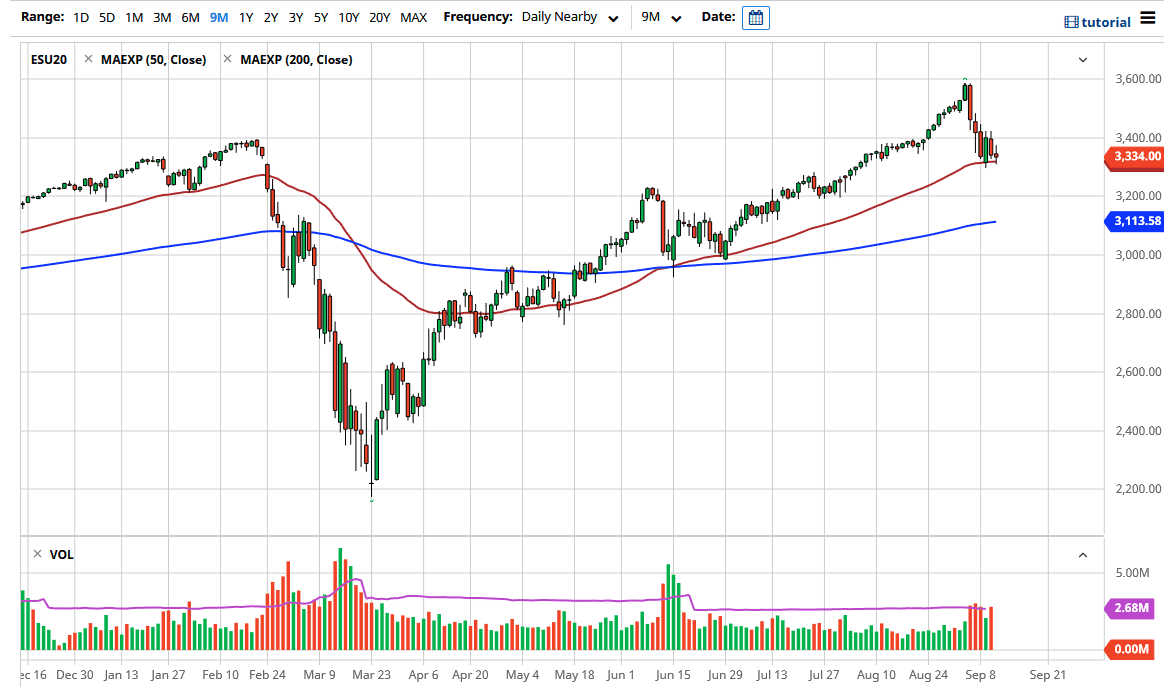

The S&P 500 has initially tried to rally during the trading session on Friday but gave back all of the gains in order to form a very ugly candlestick. This candlestick looks a bit like an inverted hammer, so if we were to turn around in recapture the 3400 level, it would be a very strong sign for the S&P 500, sending it back towards the highs. However, markets certainly look a bit sick at this point, so it is difficult to imagine that it is going to be easy to make that happen.

The 50 day EMA sits just below and a lot of technical traders will be paying attention to that. Having said that, I do not necessarily think that it is a make or break type of situation, because if we break down below there then we will simply go looking towards the 3200 level underneath which should be significant support. With this, I like the idea of waiting to see if we break down below the lows of the week, and then I would put money to work.

To the upside, I think that a break above and more importantly a close above the 3400 level could send this market much higher and would be something that people take notice of. At that point, I think you would have a lot of momentum traders jumping into this market trying to take advantage of that and push towards the all-time highs. I do expect that happens eventually, and it should be noted that the 50 day EMA really seems to be putting up a bit of support. Even a breakdown from here and down to the 3200 level I think only attracts more buyers in the end. The stock markets continue to be supported by the Federal Reserve and one would have to think that it is only a matter of time before somebody says something to support them, but even as tough as the last week and ½ or so has been, we are not that far from the all-time highs. Because of this, intervention via action or verbal probably takes a while to get here but most Wall Street traders feel confident that Jerome Powell will not let these markets collapsed at this point, and certainly, Donald Trump will not as we are getting close to the election.